US Growth Companies With High Insider Ownership

The U.S. stock market has shown mixed performance recently, with the S&P 500 and Dow Jones Industrial Average gaining while the Nasdaq Composite slipped slightly. Amid this backdrop, investors often seek growth companies with high insider ownership as these firms can offer strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.6% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.8% |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.1% |

Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.9% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 31.3% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

Clene (NasdaqCM:CLNN) | 22.3% | 62.6% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 75% |

Carlyle Group (NasdaqGS:CG) | 29.5% | 22.8% |

BBB Foods (NYSE:TBBB) | 22.9% | 70.7% |

Let's dive into some prime choices out of the screener.

Cipher Mining

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cipher Mining Inc., with a market cap of $1.22 billion, develops and operates industrial-scale bitcoin mining data centers in the United States.

Operations: Cipher Mining Inc. generates revenue primarily from data processing, amounting to $153.08 million.

Insider Ownership: 18.6%

Revenue Growth Forecast: 36.4% p.a.

Cipher Mining, a growth company with high insider ownership, has shown significant earnings and revenue growth forecasts, expected to outpace the US market. Despite recent substantial insider selling, the stock trades at 81.1% below its estimated fair value. Cipher became profitable this year and reported strong July production results with 178 BTC mined and an operating hash rate of 8.7 EH/s. Additionally, rumors suggest potential M&A activity as the company explores a sale following takeover interest.

VSE

Simply Wall St Growth Rating: ★★★★☆☆

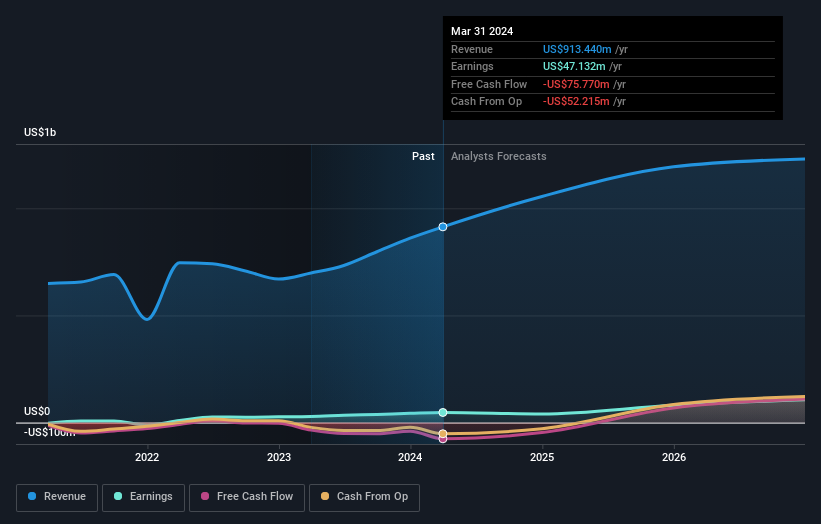

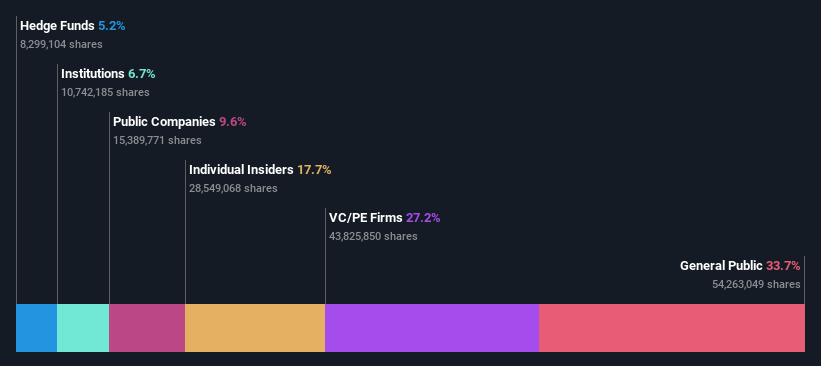

Overview: VSE Corporation operates as a diversified aftermarket products and services company in the United States with a market cap of approximately $1.56 billion.

Operations: The company's revenue segments include Fleet at $312.91 million and Aviation at $661.27 million.

Insider Ownership: 12.7%

Revenue Growth Forecast: 12.4% p.a.

VSE Corporation's earnings are projected to grow 56.1% annually, surpassing the US market's growth rate. Despite recent financial challenges, including a net loss of US$2.78 million in Q2 2024, revenue increased to US$265.96 million from US$205.22 million year-over-year. VSE has been added to multiple Russell Growth Indices and filed a Shelf Registration for various securities, indicating strategic financial planning amid expected significant earnings growth over the next three years.

Click to explore a detailed breakdown of our findings in VSE's earnings growth report.

The valuation report we've compiled suggests that VSE's current price could be inflated.

ZKH Group

Simply Wall St Growth Rating: ★★★★★★

Overview: ZKH Group Limited operates a trading and service platform for MRO products, including spare parts, chemicals, manufacturing parts, general consumables, and office supplies in China, with a market cap of $450.99 million.

Operations: The company's revenue segment primarily consists of Business-To-Business Trading and Services of Industrial Products, generating CN¥8.64 billion.

Insider Ownership: 17.7%

Revenue Growth Forecast: 21.8% p.a.

ZKH Group Limited's revenue is forecast to grow at 21.8% annually, outpacing the US market. Despite a recent net loss of CNY 90.9 million in Q1 2024, the company has shown consistent earnings growth over five years and is expected to become profitable within three years. The Board authorized a US$50 million share repurchase program, indicating confidence in its financial stability and future prospects despite recent executive changes and share price volatility.

Next Steps

Click this link to deep-dive into the 175 companies within our Fast Growing US Companies With High Insider Ownership screener.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:CIFR NasdaqGS:VSEC and NYSE:ZKH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]