US Stocks With High Insider Ownership Boasting Up To 116% Earnings Growth

As the U.S. stock market navigates a landscape marked by rising Treasury yields and fluctuating oil prices, investors are recalibrating their expectations amid shifting economic signals. In this environment, companies with high insider ownership and robust earnings growth can offer a compelling proposition, as they often indicate strong internal confidence and potential resilience against market volatility.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.2% |

Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

Hims & Hers Health (NYSE:HIMS) | 13.8% | 41.3% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

We'll examine a selection from our screener results.

Vivid Seats

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vivid Seats Inc. operates an online ticket marketplace in the United States, Canada, and Japan with a market cap of approximately $738.70 million.

Operations: The company's revenue is primarily generated from its Marketplace segment, which accounts for $651.72 million, and its Resale segment, contributing $123.89 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 20.3% p.a.

Vivid Seats, a growth company with substantial insider ownership, is trading at 70.2% below its estimated fair value and offers good relative value compared to peers. Despite a significant expected annual earnings growth of over 20%, recent profit margins have declined from last year. The company recently announced an exclusive media partnership with I Am Athlete, enhancing its brand visibility and fan engagement through interactive experiences and content creation, potentially driving future revenue streams.

Click here to discover the nuances of Vivid Seats with our detailed analytical future growth report.

RH

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RH, along with its subsidiaries, operates as a retailer in the home furnishings market with a market capitalization of approximately $6.15 billion.

Operations: The company's revenue segments include Waterworks, contributing $196.56 million, and Restoration Hardware (RH), generating $2.85 billion.

Insider Ownership: 17%

Earnings Growth Forecast: 73.3% p.a.

RH, demonstrating substantial insider ownership, is trading at 14.2% below its estimated fair value. Despite a forecasted 73.34% annual earnings growth outpacing the US market, recent financials show declining profit margins and net income compared to last year. The company reported Q2 sales of US$829.66 million but faced reduced earnings per share from continuing operations. While insiders have been more active in selling shares recently, RH's return on equity is expected to be very high in three years.

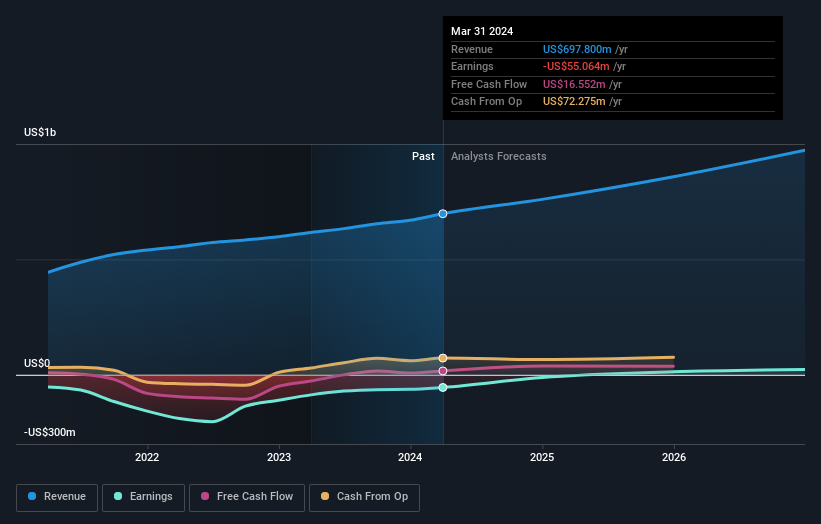

Warby Parker

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates by providing eyewear products in the United States and Canada, with a market cap of approximately $1.93 billion.

Operations: The company generates revenue from its Medical - Optical Supplies segment, amounting to $719.93 million.

Insider Ownership: 19.3%

Earnings Growth Forecast: 116.2% p.a.

Warby Parker, with significant insider buying recently, is poised for profitability within three years, surpassing average market growth. Its revenue is projected to grow at 11.4% annually, outpacing the US market's 8.7%. Despite past shareholder dilution and a forecasted low return on equity of 11%, earnings are expected to increase significantly by 116.18% annually. Recent board changes include Gabrielle Sulzberger's resignation and Teresa Briggs' reclassification to balance director terms.

Seize The Opportunity

Unlock our comprehensive list of 183 Fast Growing US Companies With High Insider Ownership by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:SEAT NYSE:RH and NYSE:WRBY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]