U.S. student loan interest rates plummet amid coronavirus downturn

Federal student loan rates have fallen to the lowest on record, offering savings for new students borrowers as the coronavirus pandemic batters the economy and paralyzes the U.S. university system.

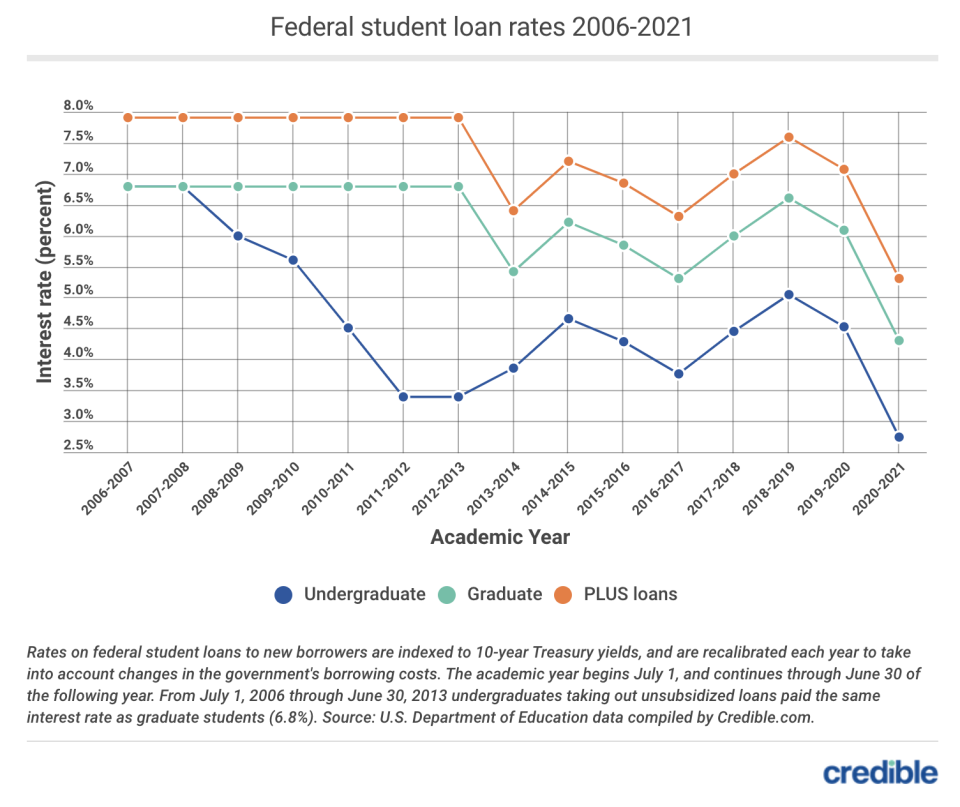

Interest rates on federal student loans taken out during the 2020-21 academic year will be 1.78 percentage points lower than the previous year — falling from 4.53% to 2.75%.

Graduate students can now borrow at a rate of 4.3%, as compared to the old rate of 6.08%. Graduate and Parent PLUS loans are down from 7.08% to 5.3%. The rates are effective from July 1 to June 30 of 2021.

“The rate decrease is hugely impactful and will save 2020-2021 federal loan borrowers hundreds to thousands of dollars over the life of their loans,” Andrew Pentis at Student Loan Hero told Yahoo Finance.

Student loan calculator from Cashay

The lower rates are in part “in part a reflection of the economic recession,” James Kvaal, a former Obama White House official and current president of the Institute for College Access and Success, told Yahoo Finance.

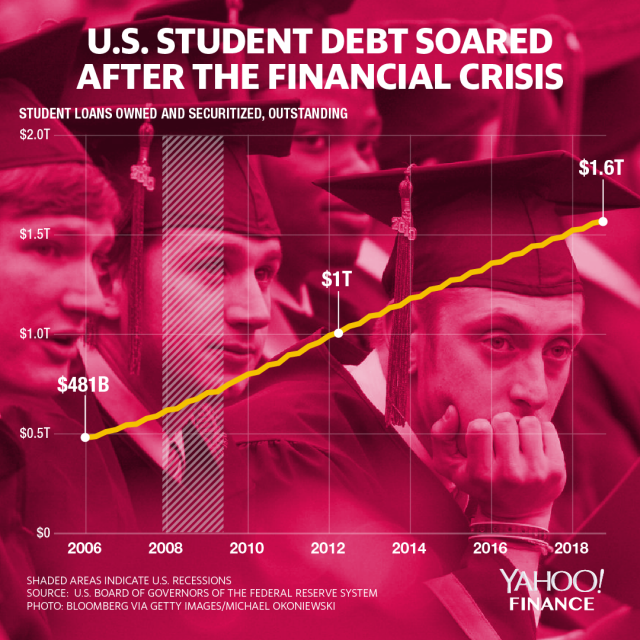

And while the loans do become cheaper overall, Kvaal added that “we are very concerned that the combination of falling family incomes and state budget cuts will make college substantially more expensive and lead more students to borrow larger loans.”

More than $72 million to be saved each month

Rates for new borrowers are adjusted every year and are calculated based on a formula tied to 10-year Treasury notes. The new rates above are based on the results of Tuesday's treasury auction.

Pentis added that overall, borrowers could collectively save more than $72 million every month in interest payments on loans taken out after July 1.

The company Credible estimates that borrowers are likely to save more than $9 billion in interest rate charges over the next decade. The company also estimated that the average student could be saving anywhere from $600 up to $2,800 in interest charges on loans taken out since July, over the next 10 years.

Concerns about the state of higher education

Unfortunately for government-backed loan providers and universities, college enrollment looks to be dropping amid the coronavirus pandemic.

There are currently fewer applications for Free Application for Federal Student Aid, or FAFSA, being submitted by high school seniors.

Meanwhile, the University of Michigan has estimated that it’s likely to lose up to $1 billion by the end of this year. State officials in Vermont have proposed shutting down some campuses.

To help support colleges and universities across the country, Congress, by way of the CARES Act, and the Education Department, threw them a lifeline, and more funding is likely to come in the next few weeks.

—

Aarthi is a reporter for Yahoo Finance.

Read more:

Student loan startup offers free assistance to borrowers amid the coronavirus pandemic

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.