Wall Street strategists are already telling clients what to expect in 2021: Morning Brief

Friday, November 6, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

And stocks are expected to keep going up.

There are eight weeks left in 2020.

And Wall Street strategists are starting to move on to 2021.

In a note to clients published Thursday, Sean Darby, global equity strategist at Jefferies, unveiled his S&P 500 price target for 2021. And Darby expects stocks will continue going up next year.

“We expect the market to reach 3,750 by end of 2021,” Darby wrote, unveiling his year-ahead price target for the first time. On Thursday, the S&P 500 closed at 3,510, implying just under a 7% gain for the benchmark index through the end of next year.

Underpinning Darby’s positive outlook is an improved outlook for corporate earnings amid a strengthening economy and an accommodative Federal Reserve.

“All of our US macro-equity-bond indicators are positive or beginning to turn,” Darby writes.

“S&P 500 earnings are finally beginning to reflect the better underlying health of the economy as the backlog of orders increases. Similarly, the Russell 3000 earnings are just turning at the same time as job openings are recovering.”

Darby adds that, “One key underwriter for the markets, under either candidate, has been the Fed with its intervention in both fixed income and credit markets. The influence of the Fed’s balance sheet should not be underestimated as the forward PE ratio has certainly tracked the ‘excess money’ in the economy.”

So while some may argue that the Fed is “out of ammo” after the unprecedented expansion of its credit facilities in the early part of this pandemic, the Fed is still a driving force behind flows in the market. On Thursday, Fed Chair Jerome Powell reiterated the central bank’s stance, saying at a press conference, “We are committed to using our full range of tools to support the economy and to help assure that the recovery from this difficult period will be as robust as possible.”

And as Canaccord Genuity’s Tony Dwyer wrote in a note to clients this week, “Remember, a significant and sustainable period of economic retrenchment comes when there is a need for money to fund forward growth but very little access to it. The opposite is true today.”

Darby also expects the political situation to serve as a tailwind to investors. At least as far as market history is concerned.

As of Friday morning, the race for president had yet to be called. However, former Vice President Joe Biden’s odds of winning improved as he took the lead in the battleground state of Georgia over President Trump. Meanwhile, the prospect of a “blue wave” in Congress has been all but ruled out by investors.

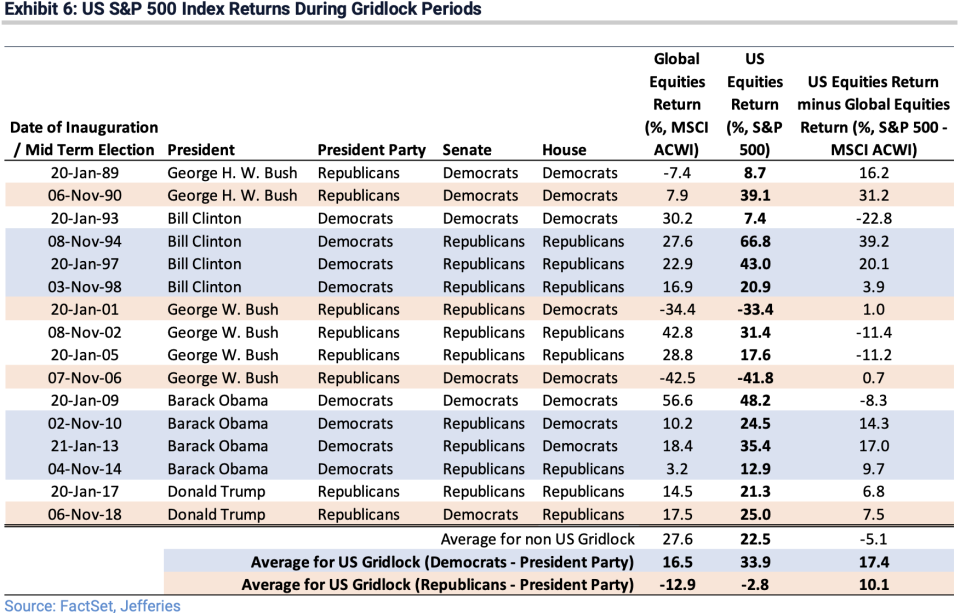

In scenarios where a Democrat is in the White House but Republicans control at least one chamber of Congress, average returns for U.S. equities have been fantastic, with the S&P 500 rising an average of 33.9% during these periods since 1989.

As Darby writes, “Although we think the equity markets ‘churn’ until a result is determined, history suggests that periods of Democrat Gridlocked Congress tend to deliver positive returns.”

By Myles Udland, reporter and anchor for Yahoo Finance Live. Follow him at @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Change in Non-farm Payrolls, October (593,000 expected, 661,000 in September)

8:30 a.m. ET: Unemployment Rate, October (7.7% expected, 7.9% in September)

8:30 a.m. ET: Average Hourly Earnings month-over-month, October (0.2% expected, 0.1% in September)

8:30 a.m. ET: Average Hourly Earnings year-over-year, September (4.6% expected, 4.7% in September)

8:30 a.m. ET: Labor Force Participation Rate, October (61.5% expected, 61.4% in September)

10:00 a.m. ET: Wholesale Inventories month-over-month, September final (-0.1% in prior print)

Earnings

Pre-market

Before market open: Viacom (VIAC) is expected to report adjusted earnings of 81 cents per share on revenue of $5.96 billion

6:00 a.m. ET: Coty (COTY) is expected to report an adjusted loss of 20 cents per share on revenue of $1.14 billion

6:30 a.m. ET: CVS Health Corp (CVS) is expected to report adjusted earnings of $1.33 per share on revenue of $66.66 billion

7:00 a.m. ET: Marriott International (MAR) is expected to report an adjusted loss of 8 cents per share on revenue of $2.23 billion

Top News

US election fuels strong week of gains on global stock markets [Yahoo Finance UK]

Uber beats Q3 earnings expectations powered by growth in Eats business, Rides falls short [Yahoo Finance]

Petco retail chain says it’s filed confidentially for U.S. IPO [Bloomberg]

Tesla unveils 'Tesla Tequila' for $250, product sold-out on website [Reuters]

YAHOO FINANCE HIGHLIGHTS

How Trump's legal woes will worsen once he leaves office

Connecticut would consider legalizing marijuana, says governor

These states suffer the worst unemployment as the pandemic recovery continues

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay