Wall Street isn’t buying its own forecast for 2020 earnings: Morning Brief

Tuesday, October 8, 2019

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

10% earnings growth in 2020?

Earnings season is about to heat up as big banks report their Q3 financial results next week. For investors, earnings season is less about what management reports about the past and more about what management forecasts for the future. After all, the value of a stock overwhelmingly depends on the outlook for earnings.

According to Factset, the average Wall Street analyst expects S&P 500 (^GSPC) earnings to grow 10.5% in 2020.

But many of Wall Street’s most prominent banks are telling clients that ain’t happening. In a note to clients on Monday, Morgan Stanley U.S. equity strategist Michael Wilson took a chart with that consensus 2020 earnings forecast and annotated it with two words: “Looks unrealistic.”

“Consensus expects S&P 500 EPS will rise by 10% in 2020 compared with our top-down forecast of 6%” Goldman Sachs U.S. equity strategist David Kostin said on Friday. “Consensus expects margin expansion of 54 bp will drive aggregate EPS growth. However, we forecast profit margins will only rise by 14 bp as input costs continue to challenge the increase in prices charged. Many firms have been unable to keep pace with their input cost inflation.”

Some of these more cautious strategists point to a slew of underestimated cost pressures including from higher costs of goods amid the trade war and rising wage costs amid the increasingly tight labor market.

Others warn that revenue could disappoint amid the shaky economic backdrop. On Monday, Bank of America Merrill Lynch U.S. equity strategist Savita Subramanian said: “2020 consensus numbers still look too high to us... which we think are overly optimistic given macro data.”

So, what’s going on with these consensus 2020 numbers that seem to be getting no love from anyone willing to speak up?

Morgan Stanley’s Wilson attributes it to the fact that very few companies have actually provided their own forecasts for 2020.

“As we have moved through this year and watched earnings guidance come down every quarter, the estimates have followed,” Wilson said last week. “However, the numbers haven’t changed as much for 2020 because companies don’t guide that far out, leaving 2020 estimates unrealistic, in our view.”

For what it’s worth, strategists say their clients are just as skeptical.

“Not surprisingly, investors are reluctant to buy into such optimism given anemic near-term earnings and weak economics,” Credit Suisse U.S. equity strategist Jonathan Golub said. “Many are quick to warn that projections will invariably fall, putting pressure on stock prices.”

On September 20, Citi U.S. equity strategist Tobias Levkovich initiated a 2020 year-end target of 3,300 for the S&P 500, which would reflect 10%+ gains from here. But he too is cautious about earnings growth, forecasting EPS to climb just 4.8%.

“Another profits reset looks probable for 2020 but many on the Street already think that low single-digit numbers are appropriate based on client survey work,” Levkovich said.

It’s unfortunate that there can be so little clarity about what’s happening next year, especially as stock market investors should be thinking on multi-year time horizons. For what it’s worth, Wall Street strategists have historically been proven to be too cautious about earnings growth. So, maybe 10% earnings growth isn’t so unlikely.

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Economy

6 a.m. ET: NFIB Small Business Optimism, September (102.5 expected, 103.1 in August)

8:30 a.m. ET: PPI Final Demand month-on-month, September (0.1% expected, 0.1% in August); PPI excluding food & energy month-on-month, September (0.2% expected, 0.4% in August); PPI Final Demand year-on-year, September (1.8% expected, 1.8% in August); PPI excluding food & energy year-on-year, September (2.3% expected, 2.3% in August)

Earnings

7:30 a.m. ET: Domino’s Pizza (DPZ) is expected to report adjusted earnings of $2.06 per share on $823.10 million in revenue, according to data compiled by Bloomberg

4:05 p.m. ET: Levi Strauss (LEVI) is expected to report adjusted earnings of 28 cents per share on $1.44 billion in revenue.

Top News

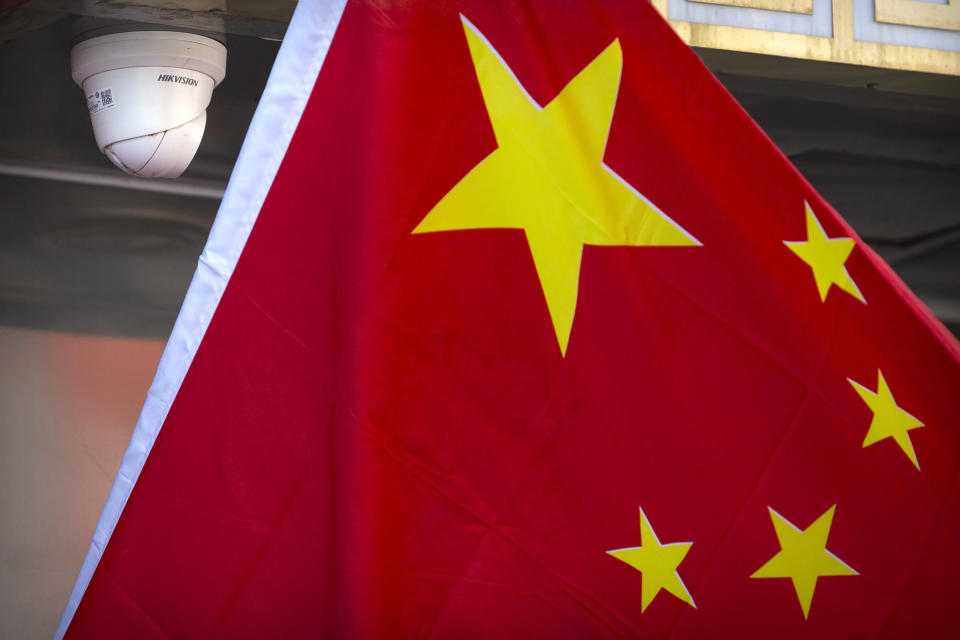

China signals It will hit back over US tech blacklist [Bloomberg]

US and Japan sign limited trade deal [Yahoo Finance UK]

Hong Kong Stock Exchange drops $36B bid for London Stock Exchange [Yahoo Finance UK]

Central banks: Negative interest rate policy was 'effective' in providing stimulus [Yahoo Finance]

YAHOO FINANCE HIGHLIGHTS

Kyle Bass rips US companies' 'Faustian bargain with the devil' in NBA-China firestorm

Why Trump’s tax returns still matter

Nickelback sees 569% surge in song downloads after Trump's 'Photograph' tweet

Wendy's may have to spend a dizzying amount of money to challenge McDonald's Egg McMuffin

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.