Wall Street managers have cost Americans more than $600 billion over the past decade

Over the last decade, fund managers who oversee the pensions of the nation’s teachers, firefighters, police and other government workers have doubled down on an investment strategy that has cost U.S. taxpayers at least $600 billion, possibly more than $1 trillion, investment data and calculations by Yahoo Finance found.

Seeking higher gains, pension fund managers have upped their investment in so-called alternative strategies that are costly and weigh down returns, data shows.

“We find that some of the worst-performing plans are those that went into alternatives late in the last decade,” said Jean-Pierre Aubry, a research director at the Center for Retirement Research at Boston College who studied the impact of investing in alternatives on public pension funds.

Alternative funds invest in things like hedge funds, private equity, real estate or commodities, rather than traditional stocks and bonds. Because pensions are guaranteed, the underperformance has hit taxpayers in the form of budget cuts for schools, hospitals and libraries and decreased spending on infrastructure, health care and other public projects.

Aubry’s studies show that across the board, public pension fund managers have thrown increasingly more money at these complex and pricey alternative funds, despite the fact that they consistently underperform simple index funds available for a fraction of the fee cost.

Fund managers have moved to alternative investments, in part, because when competing for the contracts to manage pensions, they sold pension boards on expected high returns that have not materialized. They are now trying to provide a jolt to the plans, which are largely underfunded, said Scott Kubie, chief investment officer at financial management firm Carson Group.

“Those high assumptions allowed [the employees] to make not as high contributions,” Kubie told Yahoo Finance. “They’re trying to find a way to catch up… because they haven’t covered the liabilities. I don’t know if that ends particularly well.”

State pension funds underperforming

Several studies have shown that pension fund managers are unable to consistently beat the market. And the growing popularity of alternative investments has only exacerbated the trend.

Data from the Center for Retirement Research at Boston College shows that state and local pension plans steadily increased their holdings of alternative investments, rising from 9% in 2005 to 24% in 2015. A 2017 study from Coller Capital found that a net 23% of investors plan to increase their allocations to private equity over the next 12 months.

With the nation’s pension liabilities having risen to $6 trillion, Jeff Hooke, a lecturer at Johns Hopkins University, recently conducted a report for the Maryland Public Policy Institute that found the state had lost billions in retiree income on account of the fees and lost revenue.

“The sales pitch of the alternatives community is ‘We’ve got some kind of secret sauce. Our returns are going to be higher than stocks and bonds,'” Hooke, who has authored numerous studies on the performance of public pension funds, told Yahoo Finance. “The only problem with the sales pitch is it doesn’t work.”

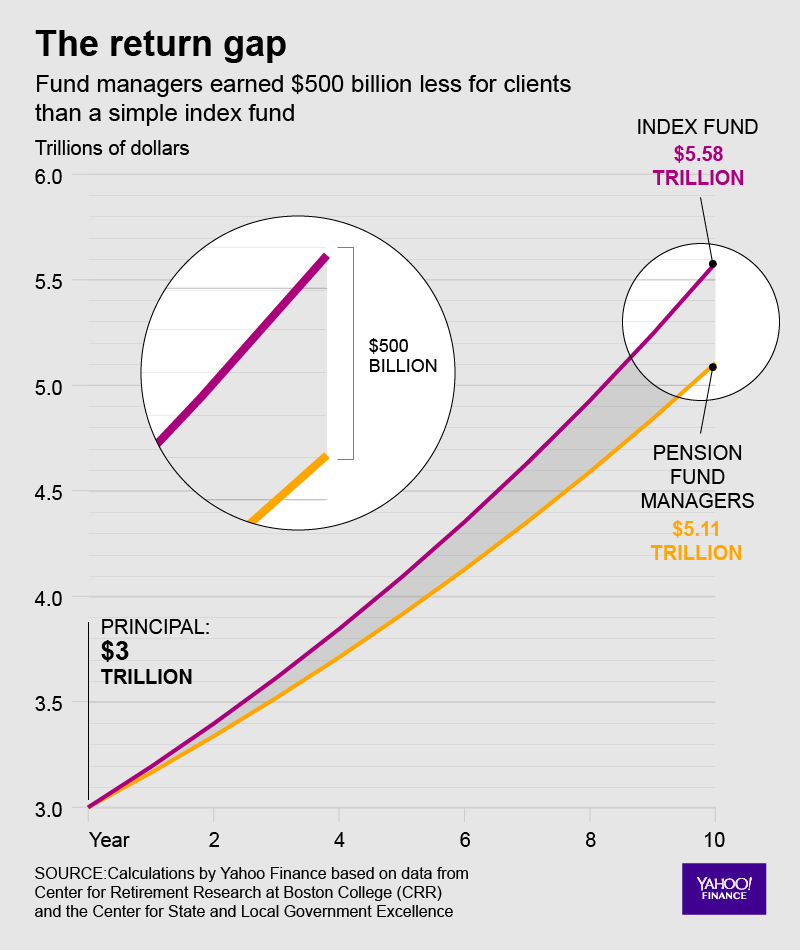

Hooke and co-author Carol Park found that of the 33 states for which data was available, the average state pension fund returned 5.46% over a 10-year period ended June 2017. A sample index fund of 60% stocks and 40% bonds returned 6.4% on an annualized basis during that time, they found.

That difference may not sound like much, but it translates to $474 billion during the period, according to compound interest calculations by Yahoo Finance based on national pension account holdings of $3 trillion in 2007.

The nation’s pension fund returns have also been hit by fees. Hooke’s study found that state pension funds paid, on average, fees totaling 0.56% of assets held to fund managers during the 10-year period. Had the nation’s collective pension fund managers invested in the 60/40 Vanguard Balanced Index Fund, for example, which carries a 0.07% fee, they would have saved $150 billion over 10 years.

In fact, the total amount pension funds could have saved by simply investing in index funds could be more than $1 trillion. In addition to the lower returns and higher fees that add up to $624 billion, data for 17 states were not disclosed, and the calculations don’t include funds contributed by workers and employers during the 10-year period.

The difference between the lowest fees paid by a state — 0.12% for Oklahoma — and the highest — 1.67% for Missouri — translates to nearly $500 billion. All that extra money paid for fees has translated into worse results. Oklahoma’s pension fund has generated a 5-year net return of 8.6% while Missouri has netted a 5.9% return during that time, according to Hooke and Park’s data.

Is now the time for alternatives?

Despite their unimpressive record, some argue that now is the right time to move into alternative investments. Investors like Kubie point out that alternatives like hedge funds perform better during times of economic stress. With a number of market analysts expecting a recession to hit soon and for it to be especially devastating, investing in alternatives could bode well for taxpayers in the future.

Aubry of the Center for Retirement Research says the data show investors who put funds into alternatives before the financial crisis had the best performance of public pension fund managers. Meanwhile, those who began putting money into alternative funds after the crisis — chasing strategies that worked in the past — fared the worst.

“[Alternative funds] were helpful in the financial crisis, 2008-09, but basically after that they have done much, much worse than traditional equity,” he said. “That’s supposed to be their role — to do the opposite of equities. When markets are booming, they are going to be a drag, but they are helpful in downturns.”

Unfortunately, in the current nine-year bull market, that has meant a sizable drag.

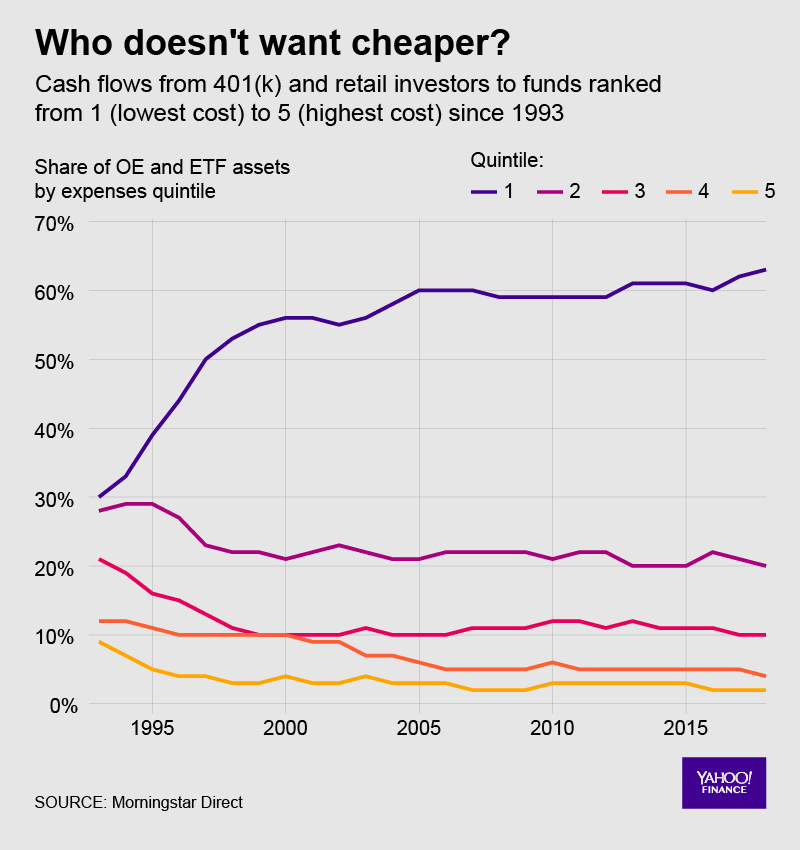

U.S. pension funds have been investing in high-priced alternative funds despite a general trend in the opposite direction. Data from Morningstar Direct obtained exclusively by Yahoo Finance shows the average cost of investment funds has declined and that far more 401(k) fund managers are choosing to go with the cheapest funds.

More than double the number of investors own funds that Morningstar categorized as its least expensive than did 25 years ago, and that number has increased by 4% since 2008 with 63% now invested in funds rated by Morningstar as the lowest-cost.

Patricia Oey, a senior analyst at Morningstar, said the move to cheaper funds has come as 401(k) plan managers feel pressured to disclose and therefore lower fees to meet investor demands. Morningstar reported earlier this year that it estimates investors saved more than $4 billion in fund fees last year by continuing a move toward lower-cost funds.

“Broadly speaking, everyone is looking for lower cost,” Oey said. “Whether it’s on 401(k) platforms or individual investors or advisors, everyone is moving towards lower cost — that’s just an overall market trend. Who doesn’t want cheaper?”

—

See also:

The emerging markets feel-good story of the decade has imploded

It’s the end of the world as we know it, and investors feel bullish

Global debt jumped by $8 trillion in Q1, rising to record $247 trillion

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.