One narrative will define the stock market in 2017

The stock market in 2017 will be all about corporate taxes.

The election of Donald Trump to the White House has turned the focus of strategists across Wall Street to the impacts of an expected corporate tax cut.

Trump pledged that he would bring the corporate tax rate down to 15% from its current 39%. And for a corporate sector that has seen a profit squeeze in recent years — the so-called “earnings recession” — a major tax cut could move hundreds of billions back onto the bottom lines of corporate America.

“We estimate that President-elect Trump’s corporate tax plan could boost S&P 500 earnings by $180bn,” writes Barclays’ Jonathan Glionna.

“However, given vast differences in effective tax rates as well as other potential items in the plan, the effects on industries and stocks will vary greatly, in our opinion. Our calculations suggest the top quintile of stocks that stand to gain the most from the plan could see earnings rise by a median of 30%, while those benefiting the least would get only a 6% bump.”

Some strategists, however, have noted that even a smaller reduction in the US corporate tax rate to something like 25% would have major benefits for US corporations.

“We’re unsure how much the US corporate tax rate will be cut, but we think a significant cut is likely, and we see ~25% as most likely because it aligns with the OECD average,” writes David Bianco at Deutsche Bank.

“We think the market is underappreciating the likely big boost to S&P EPS from a lower corporate tax rate and the boost to bank profits from rising yields (and lower pension expense) and the much higher chance now of a long lasting economic expansion that rivals the 10-year US record,” Bianco added.

“We’re more confident now that the S&P will reach 2500 in 2018 before suffering its next bear market.”

Bianco expects the S&P 500 will hit 2,250 by the inauguration. On Wednesday, the benchmark index was trading near 2,210.

The Trump administration

On Tuesday night, reports surfaced that banker Steve Mnuchin would be Trump’s pick for Treasury secretary, a role crucial in shaping any tax proposals that come out of the administration.

In an interview on CNBC’s “Squawk Box” Wednesday morning, Mnuchin said that, “by cutting corporate taxes, we’re going to create huge economic growth and we’ll have huge personal income.”

Mnuchin added that the administration’s top priority was economic growth — “I think we can absolutely get to sustained 3%-4% GDP growth” — and that, “to get there, our number one priority is tax reform. This will be the largest tax change since Reagan.”

Statutory vs. effective

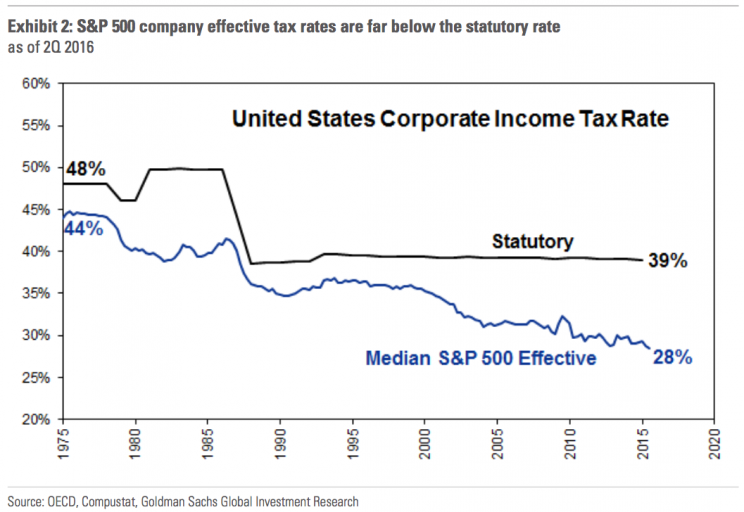

Another factor in play is that while the statutory — or legal — corporate tax rate in the US is 39%, many corporations use strategies that allow them to pay far less. The S&P 500’s effective tax rate, for example, is 28%, about 10% below the legal rate.

In a note to clients shortly after the election, analysts at Goldman Sachs outlined a number of tax scenarios that could play out in a Trump administration. Among them is a reduction in the statutory tax rate from the current 39% to 25%, while companies keep their strategies to pay less effective tax.

Under this scenario, an effective tax rate falling to 15% could see S&P 500 earnings rise 26% in 2017 compared to 2016. Assuming a price-to-earnings multiple of 18 on the S&P, Goldman pegged 2,400 as a potential target for the index under this framework.

Cash overseas

Another pillar of Trump’s tax plan is putting in place a one-time tax holiday to allow corporations with cash parked overseas to bring that money back to the US while paying a one-time, lower tax. Currently, that money would be taxed at the 39% rate; Trump has proposed 10%.

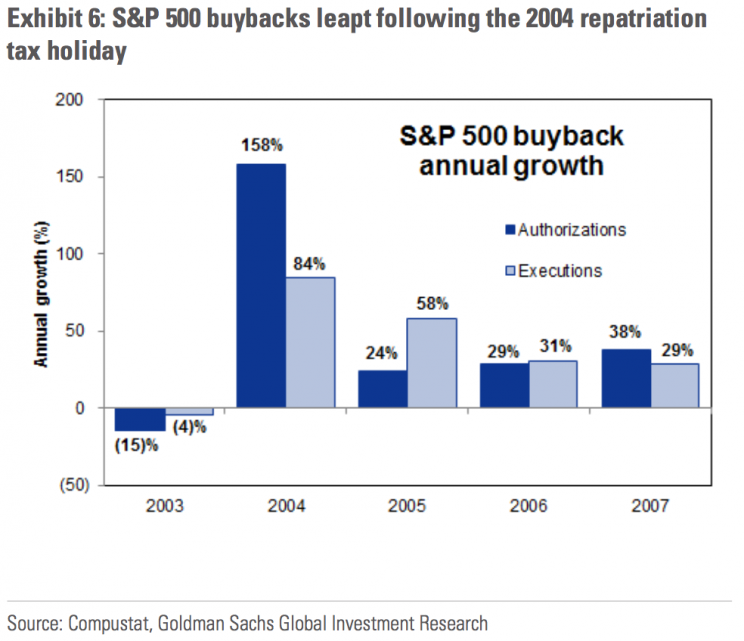

Goldman Sachs looked back at the 2004 tax holiday, which suggests a lot of that money brought back to the US would be used for stock buybacks.

Buybacks would be a positive for existing shareholders, though not necessarily boost investment inside the US, which is the political justification for these types of initiatives. Additionally, bringing dollars held overseas by US corporations could impact the plumbing of financial markets in ways that are far from clear.

Bringing this money back to the US, however, could come with some conditions, as Barclays’ Glionna outlined in a note Wednesday. Whether these conditions greatly impact how this cash is spent, however, is another issue.

“Repatriated cash, however, may come with constraints, such as using proceeds for job creation or US investment,” Glionna writes.

“The American Jobs Creation Act of 2004 (AJCA) allowed companies to repatriate dividends at a tax rate of about 5%. The proposal tied repatriation to domestic reinvestment and job creation, but cash is fungible and some studies argue that much of the funds were distributed to shareholders.”

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland