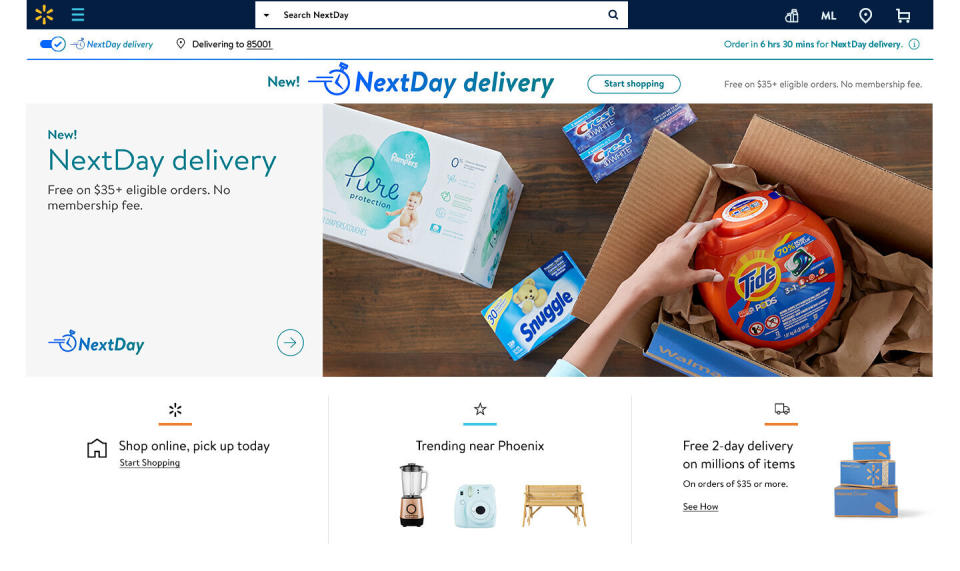

Walmart launches free next-day delivery with no membership fee

Walmart (WMT) just upped the stakes in the shipping wars with its latest offering — free next-day delivery with no membership fee.

Shoppers on Walmart.com can access NextDay delivery via a stand-alone function where they can browse up to 220,000 of the most commonly purchased items, everything from diapers to cleaning products to toys and electronics.

"Think of things like Bounty paper towels, some of our Great Value paper lunch plates, flushable wipes, diapers, dog food. Everything from that to a Little Tikes toy set," Janey Whiteside, Walmart's chief customer officer, told Yahoo Finance. "It's a combination of items that you forget that you need and you need them in a rush. If I'm a busy mom and I look at the diary and realize that tomorrow I have a kid's birthday party and I've forgotten to buy a present, there are things in there for that. There are consumable items. You'll see a range of things that we know the customers are looking for."

Orders of $35 and up are eligible for NextDay delivery, and the offering will debut in Phoenix and Las Vegas before expanding to Southern California.

"It will roll out gradually over the coming months, with a plan to reach approximately 75% of the U.S. population this year, which includes 40 of the top 50 major U.S. metro areas," Marc Lore, CEO of Walmart eCommerce U.S., wrote in a blog post.

In the blog, Lore said the service "isn't just great for customers, it also makes good business sense."

"Contrary to what you might think, it will cost us less – not more – to deliver orders the next day," he wrote.

The reason it won't cost as much is that the items will ship from one fulfillment center nearest the customer, he explained.

"This means the order ships in one box, or as few as possible, and it travels a shorter distance via inexpensive ground shipping. That’s in contrast to online orders that come in multiple boxes from multiple locations, which can be quite costly," Lore wrote.

That said, some are still skeptical about the expense associated with the new offering.

"My reaction is that it's awesome for customers. For you and me, it's great. We get more options, and it's going to be faster to get anything we order," Sucharita Kodali, a retail analyst at Forrester, told Yahoo Finance, before adding, "Is it great in the long-term from an expense standpoint? Is this the most efficient way? I think that question hasn't been answered."

Kodali doesn’t think shoppers are likely to turn down free, expedited shipping.

"The shopper doesn't value it for what it is — an incredibly expensive endeavor," Kodali said.

To Walmart's credit, though, she said the retailer is approaching it in a "smart way," by launching in a couple of cities with a finite number of eligible items and a threshold of $35.

"[They're] trying not to lose their shirt while doing it," she said, later adding, "All of those are incredibly important to making it successful."

King Kong v. Godzilla

Walmart’s move is helpful in the "King Kong versus Godzilla fight" Walmart is in with Amazon, Kodali added.

In late April, Amazon (AMZN) said it would spend $800 million in the second quarter to speed up its delivery to one day from two for all its Amazon Prime members. Presently, the e-commerce giant offers free two-day shipping and same-day delivery on $35 orders for eligible items in specific areas. A Prime membership costs $119 per year.

Shortly after the Amazon news broke, Walmart hinted at its future plans around delivery.

One-day free shipping...without a membership fee. Now THAT would be groundbreaking. Stay tuned.

— Walmart (@Walmart) April 26, 2019

"Both retailers are climbing up the next rung of immediacy. It's another form of convenience," Laura Kennedy, a vice president at Kantar Consulting, said. "Not every shopper is going to need it or think it's the most convenient option."

Forrester’s Kodali sees Walmart's move as more about maintaining wallet-share and not surrendering that opportunity to Amazon.

"I think that's really the crux of what this is," she said.

What's more, there's also the potential for Walmart to attract a different shopper from that core shopper.

Kodali believes that Walmart’s online grocery pickup and delivery, especially with the convenience and broad organic offering, has already broadened the retailer’s appeal. The new NextDay offering is billed as a "complement" to Walmart's same-day grocery delivery, which is expected to reach 1,600 stores by year-end.

"This has the ability to broaden the appeal. It's all about incremental new customers," Kodali said.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.