Warren Buffett: 'The progress of mankind has been incredible'

Warren Buffett, chairman and CEO of Berkshire Hathaway (BRK-A, BRK-B), has been a consistent voice of optimism on the U.S. economy and American innovation.

Even as the coronavirus pandemic sparked an unprecedentedly swift drop in equity markets this year, Buffett maintained his characteristically upbeat tone.

“The progress of mankind has been incredible. And that won't stop,” Buffett told Yahoo Finance’s editor in chief Andy Serwer in a March 10 interview at Berkshire Hathaway’s headquarters in Omaha, Nebraska.

While U.S. history is riddled social and economic turmoil, the country always seems to come out on top.

“We haven't forgotten how to make progress in this country. And we haven't lost interest in making progress,” he added. “And that will benefit to varying degrees of all kinds of people, I think, around the world. But there will be interruptions.”

When discussing investments, Buffett often reminds listeners to think long-term as it is difficult to predict cyclical economic downturns.

“I don't know when they will occur, and I don't know how deep they will occur,” he said. “I do know they will occur from time to time, but I also know that we'll come out better on the other end.”

Buffett used Serwer’s trip from NYC to Omaha to illustrate his thinking.

“You flew over a country that 250 years ago, there wasn't anything here,” Buffett added. “That's only three of my lifetimes, and there wasn't anything here ... And I mean, it's incredible.”

The pandemic has, however, impacted Berkshire Hathaway’s famed annual shareholder meeting this year, which is set to take place on Saturday, May 2. The event, often called the “Woodstock of Capitalism,” with thousands of investors convening in Omaha to hear directly from Buffett and Berkshire Vice Chairman Charlie Munger, will not include a physical audience this year. Though, it will be live-streamed exclusively on Yahoo Finance.

This year Munger won’t be joining Buffett on the stage, and in another departure from the format of past shareholders meetings, Greg Abel, Berkshire’s vice-chairman of the non-insurance operations, will join Buffett, with shareholders able to ask questions through three journalists.

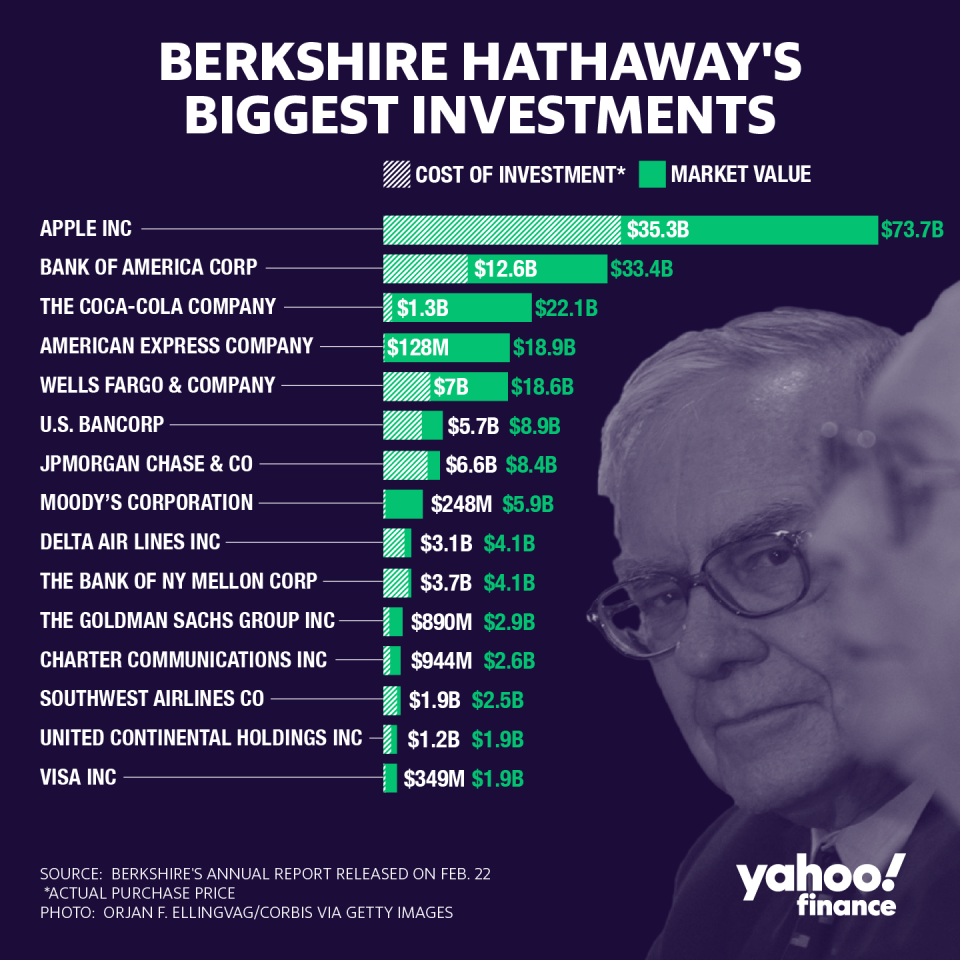

In the weeks since the COVID-19 outbreak escalated in the U.S. in mid-March, Berkshire Hathaway has trimmed stakes in several of its portfolio companies amid the broader drawdown in the stock market. Berkshire Hathaway unloaded some shares in airlines Delta (DAL) and Southwest (LUV), and sold a small portion of its Bank of New York Mellon (BK) stake earlier this year, according to regulatory filings in April.

Still, however, Berkshire has been known for generally maintaining long-term stakes in its holdings, reaffirming Buffett’s own core beliefs in what he calls the “American tailwind.”

“If you stick around long enough, you'll see everything in markets,” Buffett said. “And it may have taken me to 89 years of age to throw this one into the experience, but, you know, the markets, if you have to be open second by second, they react to news in a big-time way.”

“Things can always change tomorrow,” Buffett added. “And markets will be down 50% occasionally in your lifetime, if you live long enough. And overall, stocks are a very good place to be, but never on leverage.”

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

What we can learn from the 17 stock market crashes since 1870

Nike 3Q revenue tops expectations as surge in China digital sales helps offset store closures

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Find live stock market quotes and the latest business and finance news