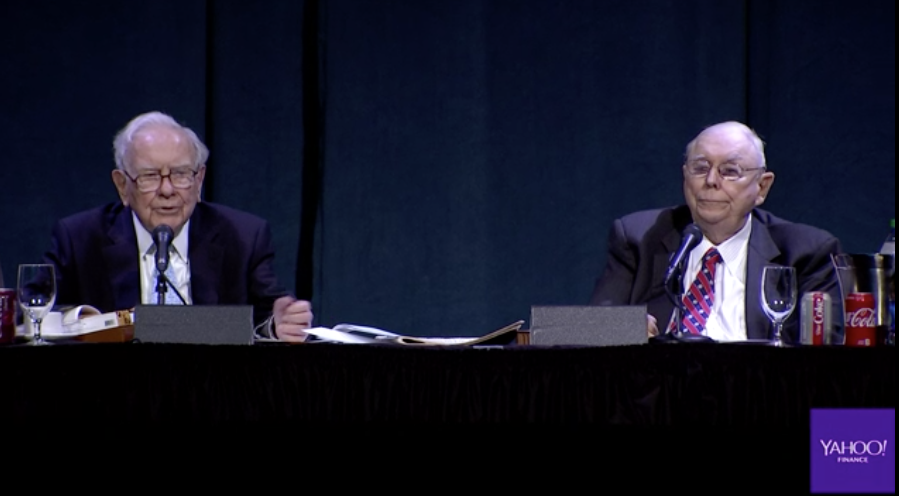

Warren Buffett and Charlie Munger answered some tough questions at Berkshire Hathaway's annual meeting

Berkshire Hathaway (BRK-A, BRK-B) held its annual shareholder meeting in Omaha, Nebraska. Led by chairman and CEO Warren Buffett and vice chairman Charlie Munger, the meeting draws around 42,000 investors, both young and old, seeking wisdom from the investing legends.

Buffett kicked things off by addressing Berkshire Hathaway’s Q1 net loss of $1.14 billion, which the company reported on Saturday morning. This was largely due to an accounting change that forced the company to report $6.2 billion in unrealized losses in its stock portfolio. The key word here is “unrealized,” which means that these were just paper losses. This is unlike “realized” losses which are booked from actually selling stocks.

“It really is not representative of what’s going on in the business at all,” Buffett said.

This speaks to Buffett’s philosophy on investing in general. Sure, there’ll be what Buffett described as “truly wild and capricious” swings in prices in the short term. But what matters is where you are in the long run.

Buffett and Munger talked about investing, cybersecurity, health care, China, trade policy, Wells Fargo, and firearms, among other things.

China gives the US goods it wants in exchange for ‘a piece of paper’

Trade policy has been dominating the headlines. Team Trump recently traveled to China in an effort to negotiate trade terms that would be more favorable to the U.S. Trump’s primary negotiating tactic has been the threat of tariffs, which most economists agree is a lose-lose option.

“The United States and China are going to be the two superpowers of the world, economically and in other ways, for a long, long long time,” Buffett said. “We will have disagreements, [but] the benefits are huge and the world is dependent on [that relationship.]”

One metric Trump complains about is the trade deficit the U.S. has with China. Buffett, however, doesn’t see this as a major issue right now.

“When you think about it, it’s really not the worst thing in the world to have someone send you the goods that you want and for you to send a piece of paper,” Buffett said of the trade deficit.

“It is a win-win situation,” Buffett said on trade, noting you only run into trouble when one side wants to win a little more.

Buffett acknowledges that free trade and globalization, while beneficial, have come with costs. He stressed that America’s leaders need to get better at communicating the benefits of trade. “You really need an educator-in-chief as president,” Buffett told Yahoo Finance’s Andy Serwer in March. “That’s what [Franklin Delano] Roosevelt was so good at. We needed an educator-in-chief in 1933. And that, you could argue, was the most important part of his presidency.”

Buffett and Munger exhibited a lot of restraint when talking about the Trump administration, opting to focus more on business and economics instead.

[Read More: Warren Buffett explains why trade with China is a win-win]

Cyberthreats are “uncharted territory”

Cybersecurity is top of mind for Warren Buffett and Berkshire Hathaway. As an insurance company, Berkshire must suss out the risks that go with underwriting a policy that covers cyberattacks.

“Frankly, I don’t think we or anybody else really knows what they’re doing,” Buffett said of covering these risks. “It’s just really, really early in the game. We don’t know the interpretation of the policies will be.”

Buffett said that cyber is a risk that could cause a “super-cat,” which is insurance jargon for super-catastrophe.

“[Cyber] is uncharted territory, and it’s going to get worse not better,” he said. “You’re right in pointing that out as a very material risk that didn’t exist 10-15 years ago and will get more intense as time goes on.”

[Read More: Warren Buffett says cyber risk will get worse, not better]

Sticking with Wells Fargo

Wells Fargo (WFC) has been one of Berkshire Hathaway’s largest investments for a long time. So, when news broke in 2016 that Wells Fargo employees were incentivized to set up millions of fraudulent accounts for customers, Buffett came under pressure to either dump his position or take action as a major shareholder.

“Wells Fargo is a company that proved the efficacy of incentives, and it’s just that they just had the wrong incentives,” Buffett said.

At this point, Buffett and Munger see Wells Fargo’s worst days largely behind them.

“I see no reason to think that Wells Fargo — going forward — is anything other than a very, very large well-run bank that had an episode in its history,” Buffett said. “GEICO came out stronger, American Express came out stronger.”

“We have a large unrealized gain [in the stock],” he said. “I like it as an investment. [CEO Tim Sloan] is correcting mistakes made by other people.”

[Read More: Why Warren Buffett is sticking with Wells Fargo]

Single-payer health care is coming, Munger predicts

Munger says he expects to see single-payer health care in the United States. He said this after a question about the Berkshire-Amazon-JPMorgan enterprise that is intended to provide healthcare to its 840,000 employees.

“I suspect that eventually when Democrats control both houses of Congress and the White House, that we will get single payer medical care and I don’t think it’ll be much more friendly than any of the PBMs,” Munger said.

[Read More: Buffett: Berkshire-Amazon-JPMorgan healthcare initiative to have a CEO in ‘a couple of months’]

Buffett takes controversial position on guns

An investor expressed disappointment in Buffett’s unwillingness to take a more forceful position on gun control. As some big companies have distanced themselves from doing business with pro-gun advocates, Buffett and Berkshire has largely been mum.

“I don’t think that we should have a question on the GEICO policyholder form, ‘Are you an NRA member?,’ ” he said. “‘If you are, you just aren’t good enough for us.'”

“I do not believe in imposing my political opinions on the activities of our businesses,” he said. “If we get into what companies are pure and which ones aren’t pure, I think it is very difficult to make that call.”

[Read More: Warren Buffett wants to keep business and his politics separate]

“It seemed like a good idea at the time”

In his opening remarks, Buffett went way back and reflected on the investing environment in 1942. He shared newspaper clippings of that showed World War II headlines dominating the front page of the New York Times.

“We were in trouble, big trouble, in the Pacific,” he said.

But at the time, he saw an opportunity to cheaply buy the preferred shares of a company called Cities Service. On March 11, 1942, he bought three shares at $38.35. Immediately, prices started to fall. But four months later, he was able to sell at $40 for a quick profit.

“This is not a happy story,” he said, noting that in a just a few years the share price went to $200.

Buffett went on to remind folks of the importance of having patience and thinking long term with investments.[Edited by Sam Ro, Michael Kelley, Aarthi Swaminathan]

—

More of Yahoo Finance’s coverage of Warren Buffett and Berkshire Hathaway:

Here’s how Warren Buffett wants to be remembered when he dies

Warren Buffett: One metric tells me the most about the future

—

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn