Warren Buffett's bet against hedge funds had an 'unforeseen investment lesson'

Legendary investor Warren Buffett, the CEO of Berkshire Hathaway (BRK-A, BRK-B), writes in his newest annual letter that his ten-year-long bet with a hedge fund manager delivered an “unforeseen investment lesson.”

“Though markets are generally rational, they occasionally do crazy things,” he said. “Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon such as alpha and beta. What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period — or even to look foolish — is also essential.”

In other words, the takeaway is that everyday investors can beat the so-called “smart money” and they don’t have to shell out hefty investment fees or execute a lot of trades to do it.

A ten-year bet

Buffett, who has argued that investors — both small and large — would be better off putting money in low-cost index funds, wrote in his 2005 shareholder letter that active management professionals (hedge funds), as a group, would underperform the returns achieved “by rank amateurs who simply sat still.” His thought was that the active managers who collect massive fees would leave their clients “worse off” than the amateurs who simply invested in unmanaged low-cost index funds.

At that time, Buffett offered to wager $500,000 (for charity) that no investment professional could select a set of at least five hedge fund that would match the performance of an unmanaged S&P 500 index fund. The bet was to last ten years and Buffett picked a low-cost Vanguard S&P fund as his contender.

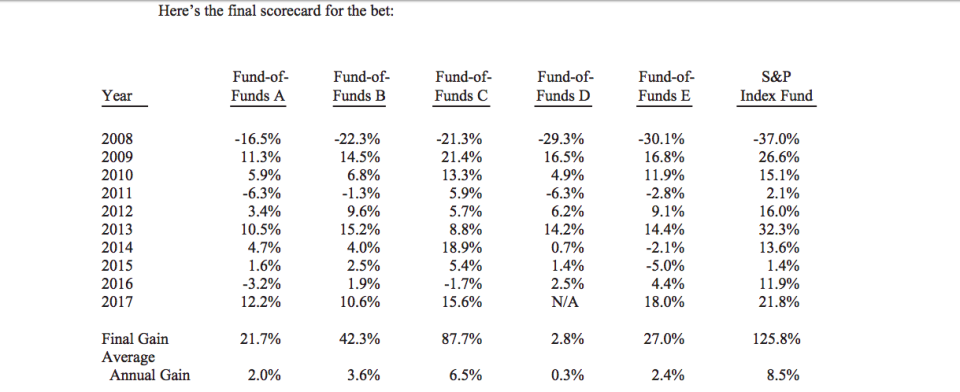

Only one person took the “Oracle of Omaha” on in December 2007. That was Ted Seides, the co-manager of Protégé Partners, a funds-of-funds that allocate to hedge funds. For his part in the bet, Seides picked five funds-of-funds with interests in more than 200 hedge funds to go up against Buffett’s Vanguard S&P index fund.

In December 2017, Buffett claimed victory, noting that the final tally has been an “eye-opener.” Buffett’s pick of a Vanguard S&P index fund delivered an average annual return of 8.5% compared to the fund-of-funds’ 2.4% average annual gain.

“American investors pay staggering sums annually to advisors, often incurring several layers of consequential costs,” Buffett wrote. “In the aggregate, do these investors get their money’s worth? Indeed, again in the aggregate, do investors get anything for their outlays?”

Buffett, who has long been a critic of fees charged by hedge funds, noted that the fund managers that were used in the bet had plenty of incentives.

“Those performance incentives, it should be emphasized, were frosting on a huge and tasty cake: Even if the funds lost money for their investors during the decade, their managers could grow very rich. That would occur because fixed fees averaging a staggering 2 1/2% of assets or so we were paid every year by the fund-of-funds’ investors, with part of these fees going to the managers at the five funds-of-funds and the balance going to the 200-plus managers of the underlying hedge funds.”

The five fund-of-funds that Protégé selected outperformed the S&P fund in 2008 as the world fell into a financial crisis. In the years following, though, they fell behind the index fund’s performance. Buffett noted that making money during that ten-year stretch “should have been easy” for these hedge funds. He added that while they prospered from their fees, “many of their investors experienced a lost decade.”

“Performance comes, performance goes,” Buffett said. “Fees never falter.”

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.