Why the dismal performance of super-unicorns will sink the We Company’s IPO

In addition to its huge losses, terrible business model, and laughable corporate governance, one of the main reasons the parent company of WeWork, the We Company, is struggling to go public is the dismal performance of other so-called super-unicorn stocks over the past couple of years. (Unicorns are companies that have achieved at least a $1 billion valuation in a private financing, whereas we define super-unicorns as companies that, like We Company, raised at least $1 billion before going public.)

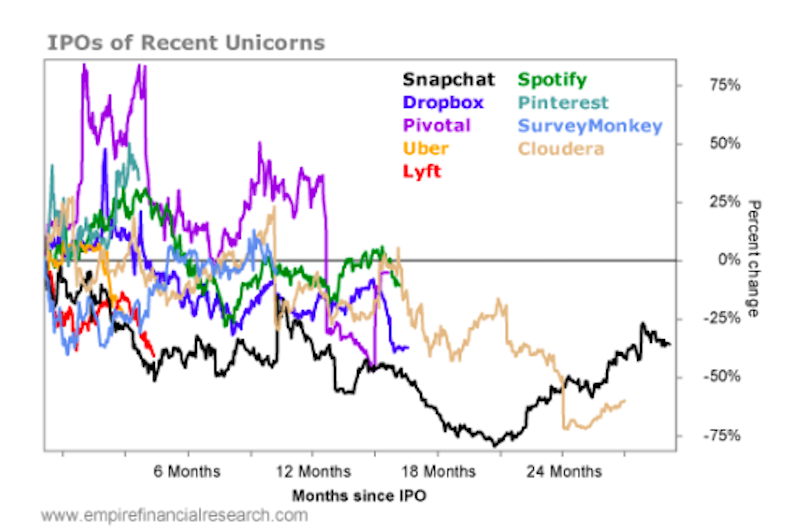

Removing a few Chinese companies, here’s the list of the nine super-unicorns that have gone public in the past few years: Snap (SNAP), Cloudera (CLDR), Dropbox (DBX), Spotify (SPOT), Pivotal Software (PVTL), SurveyMonkey (SVMK), Lyft (LYFT), Pinterest (PINS), and Uber (UBER).

As you can see from this chart, all but one of them — Pinterest — are down from their closing price on the first day of trading... And four of them are down more than 35%!

This dismal performance certainly reinforces our view that there was a bubble among unicorn stocks, especially the biggest ones, that is now bursting in a slow and painful way. We would avoid every one of these stocks like a plague — in fact, they are all good shorts, especially Uber and Lyft, whose hope of ever achieving profitability is now in doubt as California is about to pass a law making their drivers employees rather than contractors. This is likely the start of a trend that they will be unable to stop — one that will have adverse effects on many other richly valued companies that rely on exploiting low-paid, no-benefits “gig economy” workers. Investors beware!

As for the We Company, its largest investor, Softbank, is urging it to indefinitely delay its IPO so it doesn’t have to take a big write-down that would jeopardize its ability to raise its massive Vision 2 fund. But the company insists that it’s going ahead with its IPO, and is desperately stashing its valuation to get it done. It has no choice: It needs to raise $3 billion in stock to unlock $6 billion in debt — money it needs to fund its overly ambitious growth plan and cover its hideous losses, which show no sign of diminishing.

It’s not going to work. You can stick a fork in this IPO.

When that happens, the We Company is in big trouble. In fact, we think the company goes bankrupt within a year. That’s what happens when companies run out of cash — and who, exactly, is going to provide this money-losing pig with the billions of dollars necessary to keep its fatally flawed business model alive?

Happy unicorn hunting!

Whitney Tilson founded and for nearly two decades managed hedge fund Kase Capital. He is now the founder and CEO of investment newsletter publisher Empire Financial Research.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.

Yahoo Finance

Yahoo Finance