WEEK AHEAD: Final jobs report and Fed meeting before election

We’re almost there: this week marks the final full week of trading before the 2016 presidential election.

And it is not a quiet one.

On Wednesday, the Federal Reserve will announce its latest monetary policy decision, and the week will be capped by Friday’s all-important October jobs report.

Wall Street is looking for the US economy to add 175,000 jobs in October with average hourly earnings set to rise 2.6% year-over-year. The unemployment rate should drop to 4.9%.

The Federal Reserve is expected to keep interest rates pegged between 0.25% and 0.50%. Markets are anticipating the next interest rate increase from the Fed will come in December.

Elsewhere in economic data, we’ll get readings on inflation, manufacturing, and productivity during the week.

Corporate earnings season also remains in full swing, and next week features headline reports out of Facebook (FB), Alibaba (BABA), and BP (BP).

Week In Review: America, Apple, and a media mega-deal

The US economy grew at its fastest pace in two years during the third quarter, expanding at an annualized rate of 2.9% for the three months ending September 30.

But…

The better-than-expected headline gain was aided by a huge jump in inventories and trade. The inventory build that came as a result of increased fixed investment was largely a give-back after five quarters of declines. The jump in trade was the result of consecutive months of record soybean exports this summer.

Personal consumption, the driving force of the US economy, grew 2.1% in the third quarter. Solid, but down from the 4.3% growth seen in the second quarter. And so in short, the third quarter showed more of the same for the US economy: good, not great.

Wanna feel old? It’s been over a week since the $108 billion AT&T (T)-Time Warner (TWX) deal was announced late last Saturday night.

Time Warner shares closed the week at $87.47, about $20 below the implied $107.50 offer price as markets fear the deal will be shut down by regulators. Time Warner is expected to report earnings next week.

And of course it is worth reminding readers that it is Time Warner — not Time Warner Cable — that AT&T is being acquired. Even the Senate couldn’t keep the two straight.

Apple (AAPL), the world’s largest company by market cap, reported a pretty ho-hum quarter last Tuesday, beating expectations on the bottom line and reporting revenue that was roughly in-line with estimates.

The weak spot in the report was iPhone sales, which fell against the prior year period for the third straight quarter. Apple’s “holiday quarter” results — due out in January 2017 — will now certainly be scrutinized perhaps closer than they’ve ever been.

The conversation around the company, however, has sort of shifted out into the future, with analysts asking CEO Tim Cook if there is a “grand strategy” at Apple.

Selling millions — tens of millions — of iPhones each quarter is great, but you don’t remain the world’s premier consumer brand unless you define the market you dominate. Alternatively, it is hard for a company to create the greatest consumer product of its generation more than once.

Amazon (AMZN) reported a disappointing quarter on Thursday with profits missing Wall Street expectations. On its earnings conference call, Amazon management chalked up the earnings miss to increased investments in fulfillment centers and video.

Investors sold the stock anyway, with shares losing about 5% on Friday.

Market Comment: So, earnings are good?

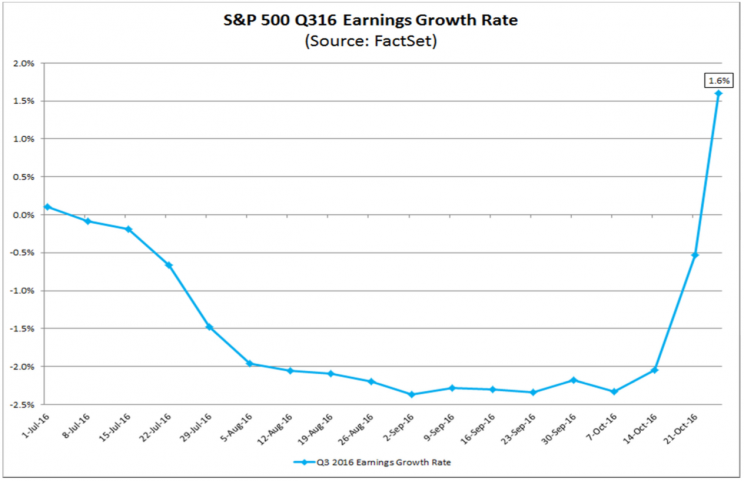

America’s earnings recession might finally be over.

After five quarters of year-on-year earnings declines, data from FactSet published Friday shows that so far, the blended growth rate for S&P 500 earnings is 1.6%.

A week ago, earnings were on track to decline again.

This would mark the first quarter of year-on-year earnings growth since the first quarter of 2015, a time when markets were just beginning to feel the impact of lower oil prices and a stronger US dollar.

For many in markets, the depressing streak of poor corporate earnings in the US has become something of a fact of life.

Profit margins peaked in 2014 and with labor costs continuing to put pressure on companies across the corporate environment, a return to any kind of increasing profitability is surely a welcome sign.

Additionally, stock values — at the end of the day — are derived from one thing: earnings. And better earnings are the catalyst for higher prices. In theory.

Economic Calendar: All about jobs

Monday: Personal income (+0.4% expected; +0.2% previously); Personal spending (+0.5% expected; +0% previously); “Core” PCE, year-over-year (+1.7% expected; +1.7% previously); Dallas Fed manufacturing (1.8 expected; -3.7 previously)

Tuesday: Markit manufacturing PMI (53.2 expected; 53.2 previously); ISM manufacturing (51.7 expected; 51.5 previously); Construction spending (+0.5% expected; -0.7% previously); October auto sales (17.49 million SaaR expected; 17.65 million previously)

Wednesday: ADP private payrolls (+165,000 expected; +154,000 previously); FOMC rate decision (0.25%-0.50% expected; 0.25%-0.50% previously)

Thursday: Initial jobless claims (256,000 expected; 258,000 previously); Nonfarm productivity (+1.6% expected; -0.6% previously); Markit services PMI (54.8 expected; 54.8 previously); ISM non-manufacturing (56.0 expected; 57.1 previously)

Friday: October jobs report (nonfarm payrolls: +175,000 expected, 156,000 previously; average hourly earnings: +2.6% expected, +2.6% previously; unemployment rate: 4.9% expected, 5% previously); Trade balance (-$39 billion; -$40.7 billion previously)

ICYMI

The FBI will review more emails related to Hillary Clinton’s private server (Reuters)

Trump’s latest plan: Spend $1 trillion on infrastructure without raising taxes (Yahoo Finance) Related: Why a big infrastructure bill is 7 years too late (Bloomberg View)

TIPS are hot right now (WSJ)

Apple’s biggest problem: Apple (Yahoo Finance) Additionally: New Macbooks (Yahoo Finance)

Scott Krisiloff’s weekly roundup of corporate commentary (Avondale Asset Management)

“I’m from rural America, and here’s why I’m done hearing about how its abandonment is why Trump happened. (Eric Garland)

“Muller joked that he asked Ken how the new dating life was going, to which Ken responded: ‘I want their body, they like my money.'” (Business Insider)

Americans are dying faster. Even millennials. (Bloomberg)

10 reasons the self-driving car hype has gone too far (FT Alphaville)

Uber loses landmark UK ruling on workers’ rights (Telegraph)

—

Myles Udland is a writer at Yahoo Finance.