What investors should expect if Donald Trump wins

Click here for Yahoo Finance’s complete coverage of the 2016 presidential election.

For a while there, it looked like Democratic nominee Hillary Clinton was the clear favorite to win the US presidential election.

But as the votes have been gradually tallied, the odds of have become less clear, with the odds of a Donald Trump victory gaining steam.

Markets are reacting violently with Dow futures plunging over 700 points late Tuesday.

In a nutshell, Clinton represents a continuation of the current administrations policies. Trump represents anything but that. With Trump, you have the promise to repeal much of the work of the Obama administration, while aggressively pushing policies that appear unfavorable to many of the US’s multinational corporations.

Trump represents uncertainty, and in the short-run investors and traders hate uncertainty.

A case can be made for a mid-teen percentage plunge

Macroeconomic Advisers recently warned that a Trump win would wipe out 7% of the S&P 500’s (^GSPC) market value, which amounts to over $1 trillion of wealth. Strategists at Citi and JPMorgan have also warned of sell-offs in the range of 3% to 5%.

“Equities and the economy are all about confidence, which would be fragile,” Parker said. “A ‘V’-shaped recovery is less likely, and the path for equities should be driven by Trump, GOP leadership, the Fed and data – and whether they engender confidence, or not.”

“If Trump wins, we see the S&P falling to ~2000 initially, or 9% from the high,” Barclays’ Keith Parker said on Tuesday. “However, without recession concerns, the necessary pre-condition for a correction [or 10%+ decline] is absent.”

“Investor concerns over Trump trade policies and uncertainty over his policy plans would weigh on equity markets,” Credit Suisse’s Lori Calvasina said on Monday. “Our base case is for incremental downside of 5-10% from the Nov 7th close, but a case can be made for a decline in the low to mid teens.”

History is riddled with surprisingly bad news

Calvasina considered some recent uncertainty shocks to derive her forecasts: “Brexit was followed by a 5% drop in the S&P 500. When the S&P 500 falls after Election Day, drops between Election Day and year end average 5% (range of -1% to -9%). If a Trump victory is viewed as a more onerous financial market event (similar to 9/11, the US debt downgrade, the European debt crisis, or the contested 2000 US Election), declines from the August 2016 highs could total -12% to -17% (another 9.6-14.7% from Nov 7th levels). History also tells us that a changing of the guard in the White House has been accompanied by a spike in volatility and a decline in equity markets, and that S&P 500 returns are weaker under Republican Presidents than Democratic ones and when Washington leadership changes than when it stays the same.”

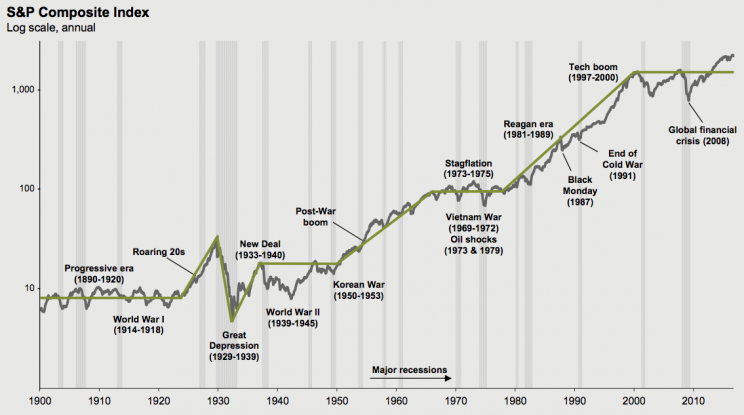

As you can see from Calvasina’s commentary, there’s certainly no shortage of uncertainty shocks in history. Below is a longer term chart of the S&P 500 annotated with some tough moments in US history.

The one commonality amid all of this history is that the market has always figured out a way to come back. Indeed, consumers will figure out how to consume, and businesses will figure out how to do business in a competitive way.

Maybe Trump won’t be that bad

There are a lot of what-if questions that linger, including whether a President Trump could actually push through his policies, and whether those policies would be so bad.

“If growth stays solid, we see a recovery into year-end to ~2100, but with asymmetric downside risks,” Parker said of his Trump scenario.

The folks over at Capital Economics note that bad news wouldn’t be all bad news.

“[W]e don’t think the knock to U.S. equities would last long if [Hillary Clinton’s] rival were to emerge victorious,” Capital Economics’ Simon MacAdam said.

He explained: “A Trump presidency would presumably mean monetary policy staying looser for longer, which would be positive for the stock market, all else equal. What’s more, we think the accompanying narrowing of interest rate differentials with other economies, in conjunction with capital outflows into safe-haven currencies such as the Swiss franc and Japanese yen, should see the U.S. currency weaken against other ‘majors,’ thereby providing further uplift to U.S. equities by boosting the dollar value of overseas earnings.”

Like we’ve said before, no matter who wins, there’s likely to be an uncertainty premium keeping stock prices from going as high as they could. But such is the nature of investing: It’s hard. There’s always something.

Click here for Yahoo Finance’s complete coverage of the 2016 presidential election.

–

Sam Ro is managing editor at Yahoo Finance.

Read more: