What Netflix's price hikes means for the streaming wars as rivals offer cheaper options

Netflix (NFLX), the streaming world’s biggest player, has offered up another round of price hikes.

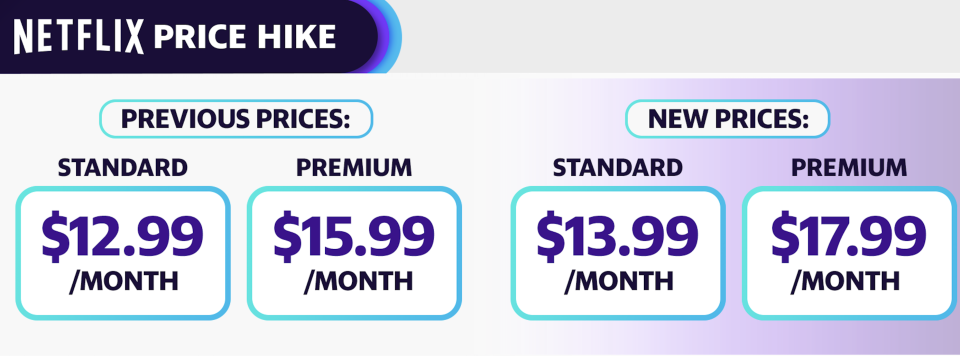

On Thursday, the technology giant announced that it plans to increase both its standard plan and its premium tier plan by $1 and $2, respectively. The stock jumped nearly 5% on the news, as investors rallied behind the company’s pricing power.

The changes will hit current Netflix users over the next few weeks and months, depending on subscribers’ billing cycles, whereas new users will pay the new prices immediately.

The last time Netflix hiked prices was back in January of 2019, which sparked some cancellations even as it also boosted revenue growth — something the company hopes to capitalize on once again. That was one of the steepest price increases at the company, with its popular standard price plan jumping by 18%.

Over the past seven years, Netflix has steadily increased its content budget every year, with some estimates placing 2020’s budget at $18.5 billion; however, coronavirus restrictions may have impacted those numbers.

It’s an interesting time to be announcing price hikes as the coronavirus pandemic has ravaged the overall U.S. jobs market, leaving many workers strapped for extra cash. Total nonfarm payroll employment currently sits at 661,000 with the unemployment rate at 7.9 percent, according to the U.S. Bureau of Labor Statistics.

Furthermore, the streaming competition is stiffer now than ever before.

Compared to Netflix, both Disney+ (DIS) and Apple TV+ (AAPL) are steals at $6.99 and $4.99 a month, respectively.

Meanwhile, HBO Max (T) charges $15 a month, whereas Peacock (CMCSA) has a three-tier pricing strategy. The NBC platform allows users to choose one totally free tier with access to most of the content with ads; or pay $5 per month for access to the full catalog (also with ads), or $10 per month for no ads.

The cheaper options could lead to an even greater cancellation rate than what Netflix saw back in 2019, but it’s a calculated risk the company’s willing to take to produce quality content — and lots of it.

Cable not dead — yet

Despite the plethora of streaming options, viewers are not ready to give up on cable just yet.

According to a new poll conducted by Staples, which surveyed 1,000 consumers across all age groups, 60% of respondents said they currently pay for one or more streaming service — plus a cable subscription.

Access to specialized channels like ESPN, CNN and The Discovery Channel is the primary driver for users holding onto their cable package, according to the survey. However, many say that if they were to cut the cord it would largely be to reduce monthly overhead.

Additionally, 24% of respondents said there is enough content on various streaming platforms to justify the cancellation.

Meanwhile, 46% cited Netflix as the one streaming platform for which they’d cancel a cable subscription. That figure far surpassed its competitors, although it seems like that won’t happen for quite some time with nearly 50% of respondents saying they have no plans to cut the cord this year during COVID-19.

Alexandra is a Producer & Entertainment Correspondent at Yahoo Finance. Follow her on Twitter @alliecanal8193

Read more:

Coronavirus claims 'Batman' and 'Jurassic' as victims, with Broadway staying dark until May

Theaters need a 'bridge' to 2021 or else ‘might not survive’ COVID-19: Movie association

Data: Netflix weathering 'Cuties' backlash, cancellations were a 'short-lived phenomenon'

How the end of 'Keeping Up with the Kardashians' hints at cable TV's demise