How the 2020 Democrats would fix Social Security

The Social Security trust fund will be depleted in about 15 years without action, according to the 2019 Trustees report. Deep cuts in benefits for current and future retirees would follow.

Social Security’s cost has exceeded its non-interest income since 2010, the report says. Funding this program is a perennial political dance in D.C. And given that older Americans have higher voter turnout than any other age group (71% of Americans over 65 voted in the 2016 presidential election, according to U.S. Census Bureau data) – the Democrats running for president are beginning to put forth their ideas for shoring up Social Security.

The total cost of the program in 2018 was $1 trillion. Democrats pretty much all want more money to be put into the Social Security trust fund and most say the program should expand.

How to pay for it

The Social Security payroll tax rate is currently 6.2% for the employer and 6.2% for the employee. But as Democrats often note, the taxes only apply to yearly wages up to $132,900.

There are a few plans to change that while raising money to shore up the program.

Sen. Bernie Sanders introduced a bill this year to apply Social Security taxes to all income (both wages and investment income) above $250,000. “It is incomprehensible that while Social Security is in financial crisis, we are allowing millionaires to stop paying in to the program,” Sanders said at the time. The bill is co-sponsored by fellow candidates Cory Booker, Kirsten Gillibrand, and Kamala Harris.

Sen. Elizabeth Warren’s plan is to “gradually eliminate the cap on income” (apparently for all wages over $132,900). Sen. Michael Bennet has also discussed “lifting the payroll cap.”

In the House of Representatives, a plan known as Social Security 2100 would allow wages above $400,000 to be taxed for Social Security. The bill would also gradually phase in a tax increase to 7.4% for both workers and employers by 2043. Former Rep. Beto O’Rourke is on board with the plan and his campaign notes that he co-sponsored a previous version of the bill when he was in Congress.

Other 2020 candidates in the House have also signed on to this plan, including Rep. Tulsi Gabbard, Rep. Seth Moulton, and Rep. Tim Ryan.

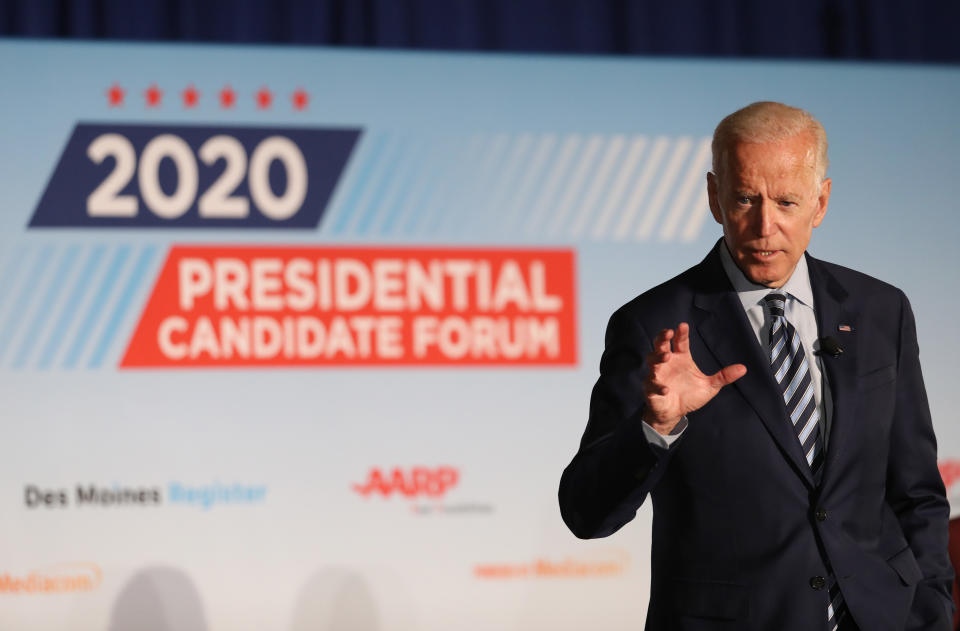

Former Vice President Joe Biden has voiced support for the idea of taxing wages above $400,000 with a “donut hole” for people who make between $132,900 and $400,000.

Mayor Pete Buttigieg has yet another approach: raise the cap to $250,000. “If we just elevated the cap on the level of income eligible for payroll taxes from $135,000 to the $250,000 neighborhood, that would go a long way towards sustainability,” he recently said.

The various plans would impact a small piece of the larger workforce. According to a recent analysis by the Center for Economic Policy Research, 6.2% of workers would be impacted by raising the current cap of $132,900. If earnings on $250,000 were taxed, it would be 1.8% of workers who pay more. If the level is $400,000, 1% would be affected.

The Republicans are, by and large, not fans of any of these ideas. Reps. Kevin Brady (R-Texas) and Tom Reed (R-NY) responded to the Social Security 2100 plan with an op-ed entitled “The Democratic plan for smaller paychecks”

Promises of new benefits

With the new revenue that would come with raising salary limits, many candidates are promising expansion of Social Security.

The Bernie Sanders plan would increase the amount of benefits for all Social Security recipients, with a special focus on helping low-income seniors. Sanders and Warren are the co-chairs of the “Expand Social Security Caucus” in the Senate.

The Sanders plan would also change the way that benefits grow with inflation, known as the cost of living adjustment, or COLA. Sanders, and most other candidates, have discussed adjusting premiums based on the Consumer Price Index for the Elderly (CPI-E). Right now, benefits are calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

The CPI-E focuses on the prices of goods that seniors spend most of their money on, like prescription drugs and medical care. Historically, the CPI-E has risen faster than the CPI-W and so the proposed change would likely lead to more generous benefits (and higher costs) over time.

The Social Security 2100 plan would deliver many of the improvements noted above (including a 2% increase in payouts and a switch to the CPI-E). That effort, led by Congressman John Larson, would also lower the Social Security taxes that some current retirees pay on their benefits.

Another area of focus on the campaign trail is on how benefits are calculated.

Social Security payouts are tabulated by averaging out the 35 highest-earning years for each recipient. In other words, people who made more money in the workforce get higher payouts in retirement.

Those who leave the workforce for an extended period see a lower average and consequently, lower benefits. Beto O’Rourke has made changing that a centerpiece of his plan. He would give a credit “equal to 50% of the average earnings of a full-time, year-round worker” to those who leave the workforce to care for a child or an ailing adult. No money up front but those who take advantage would get higher benefits in retirement.

Sen. Amy Klobuchar has also released a plan that aims to improve benefits “for widows and people who took significant time out of the paid workforce to care for their children, aging parents, or sick family members.”

Watching those who have suggested cuts

Any discussion of cutting benefits or raising the Social Security eligibility age is pretty much verboten in the Democratic party these days.

A few candidates have flirted with the concept in the past. Now, they are inclined to forget they ever said anything.

When he was first running for Congress in 2012, O’Rourke discussed the possibility of "future generations" retiring at a later age. One year later, Cory Booker reportedly did the same. Neither candidate talks like that now.

Biden has also been criticized for similar sentiments. In a speech at the Brookings Institution last year, he said “we need to do something” about the program, and noted that "I don’t know a whole lot of people in the top one-tenth of 1% or the top 1% who are relying on Social Security when they retire." That was taken as an openness to a means test for Social Security that would likely result in cuts for certain recipients. That quote led a group called Social Security Works to label Biden as “Open to Social Security Cuts,” which his spokesman quickly took issue with online.

No. @JoeBiden is not open to cutting Social Security. https://t.co/IVke2WHOe3

— Bill Russo (@BillR) June 26, 2019

The group has been policing the field on the issue and they have subsequently praised Biden after he remarked that “we should be increasing, not decreasing, Social Security.”

“Democrats are united around Social Security expansion” is what the group was able to triumphantly proclaim.

Ben Werschkul is a producer for Yahoo Finance in Washington, DC.

Read more:

Why Social Security might be a loser of the recent budget deal

A new study looks deep at how to 'pensionize' your retirement plan

Why the public option keeps coming up with presidential candidates

Former senator: 401(k) plans were 'never designed to be the retirement plan for America'

One senator with two different plans to save Social Security

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.