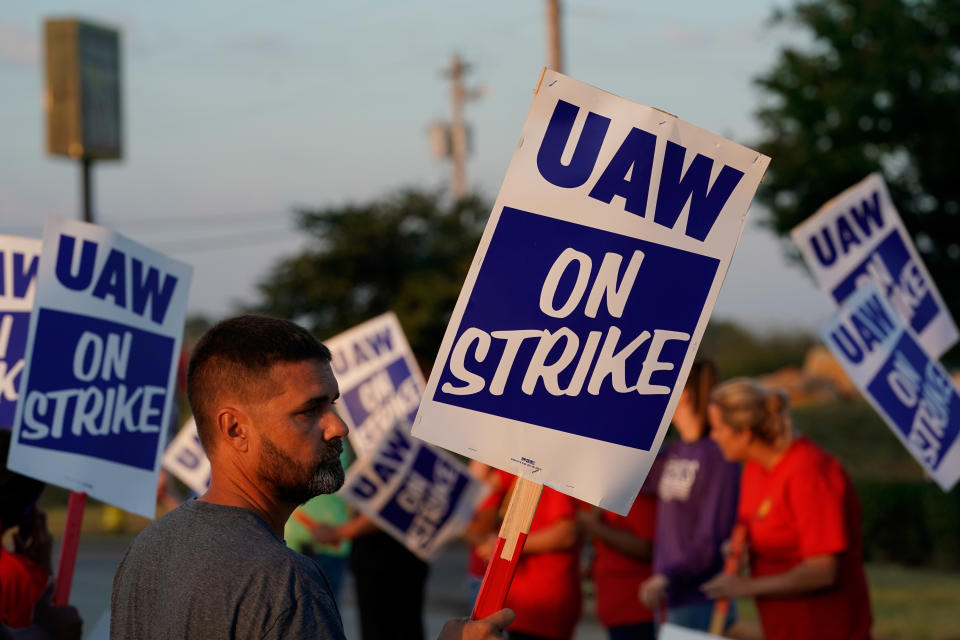

What the GM strike means for the U.S. economy

The length of time that General Motors (GM) workers remain on strike, which entered day two on Tuesday, is key to determining its economic effects.

“Overall, we think a short-lived strike won’t have a major impact on the economy, although the magnitude of the strike’s impact should increase the longer that it lasts,” JPMorgan economist Daniel Silver wrote in a note to clients. “In terms of GDP, the value added of manufacturing of motor vehicles and parts has accounted for only 0.8% of GDP lately, and General Motors is estimated to account for less than 20% of recent U.S. vehicle production.”

General Motors shares slumped on Monday, but gave back part of that loss with a 1% rebound on Tuesday. Reports suggest as many as 50,000 workers are on strike.

Workers also went on strike in 2007, which lasted several days. But in 1998, a similar GM strike went on for 54 days.

A 1998-style strike could start to affect the monthly jobs report from the Bureau of Labor Statistics (BLS), which market participants have been watching extra carefully in recent months for further confirmation that the economy remains strong. Rising trade tensions between the U.S. and China and an inverted yield curve have raised questions about just how much longer the economic expansion can continue.

“The striking workers are not counted as employed in the BLS’s payroll employment count,” Silver wrote. “If the strike lasts until the October reference week (the week ending October 12), the October report may show clear effects of the strike.”

The October jobs report won’t be released until early November.

Silver doesn’t expect the strike to affect the September jobs report (released in early October) because the reference week for the labor report ended on September 14. The strike began a few days later, on September 16.

The most recent jobs report, released in early September, showed a deceleration of job growth across the economy in August.

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

More from Scott:

Trump slams Fed Chair Powell: 'He’s like a golfer who can’t putt'

S&P 500 will plunge another 15% by the end of this year: strategist

Why China’s falling yuan could be good for U.S. stocks: strategist

Verizon Q2 profit beats estimates, boosted by wireless growth

Here is how corporate stock buybacks are changing the earnings picture

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.