The White House has a target deadline for its signature economic plan

July 28, at the latest.

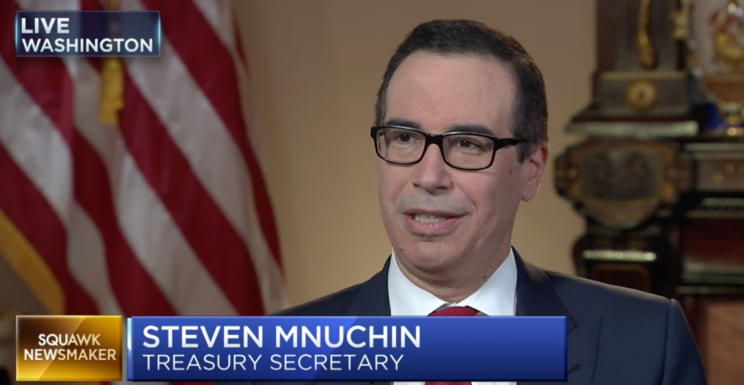

In an interview with CNBC on Thursday, Treasury Secretary Steven Mnuchin said the Trump administration is aiming to have a tax reform plan passed through both the House and the Senate by the August recess.

“We are committed to passing tax reform,” Mnuchin said. “It will be very significant.”

“We want to get [tax reform] done by the August recess,” Mnuchin added.

Currently, Congress is scheduled to leave Washington D.C. on July 28 and return to Capitol Hill on September 5.

As for the particulars of a plan, Mnuchin said that the border-adjustment tax that has been called “too complicated” by President Trump has some “very interesting aspects.” Mnuchin added that while the administration is “looking closely” at the issue, “there is a consensus on the majority of where we are on tax reform.”

The border-adjustment tax is a key piece of the legislation proposed by the House Republicans as a way to make up for the revenue lost from lower tax rates. The simple outline of the plan incentivizes exports and domestically-produced goods while taxing imports.

Following Mnuchin’s comments on Thursday morning, markets were slightly higher, but largely little-changed, indicating that investors don’t see Mnuchin’s timeline on tax reform as a concern.

Since Trump’s election, stocks in the US have rallied with the Dow gaining almost 14% and the S&P 500 up nearly 11%. On Thursday, the Dow will look to extend its streak of gains to 10 trading sessions.

Underwriting much of this market rally have been hopes that the Trump administration will cut taxes, cut regulations, pass a major infrastructure package, and avoid negative developments from new trade policies.

And while a number of analysts have questioned whether the benefits of each or any of these plans will be as great as markets project, right now it’s clear investors are giving the new administration the benefit of the doubt.

As for the markets, Mnuchin said the stock market is “absolutely” a report card for the economy.

“This is a mark-to-market business,” Mnuchin added, “and you see what the market thinks.” Which is all fine and well while stocks are rising.

As for what the administration might have to say about a stock market that is falling, Mnuchin said he doesn’t much concern himself with daily market moves and that, “we’re in an environment where there’s very attractive investment opportunities in the US, and I think that’s reflective of the administration’s goals and what the market thinks of it.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: