Why a 'blue wave' in 2020 could set cannabis stocks up to double

With market watcher after market watcher claiming a Democrat winning the presidency could spell disaster for stocks, there’s at least one sector that’s desperately cheering for a “Blue Wave” in 2020.

For cannabis companies, which have been hammered across the board this year as evidenced by the marijuana-focused Alternative Harvest MJ ETF (MJ) tumbling 35%, a Democrat in the Oval Office would be welcome news, according to CFRA senior equity analyst Garrett Nelson.

Interestingly, nearly all of the leading Democratic presidential candidates favor legalizing marijuana at a federal level, which could double the cannabis market, Nelson says. “When you go from an illicit market to a legal market, we try to think about market opportunity,” he tells Yahoo Finance. “The U.S. is about a $50 billion market right now. Over the next 15 years, the market doubles to $100 billion in the event of full legalization.”

Out of the companies best positioned to immediately capitalize on legalization (if it happens) is Canopy Growth, Nelson says, due to its already agreed-upon deal to acquire U.S. cannabis company Acreage Holdings, which boasts licenses to operate in 20 states. The deal’s activation hinges upon the sale of cannabis becoming permissible at a federal level in the U.S. Thus, Nelson’s model projects federal legalization would boost Canopy’s share price by more than 100% to reach $58 a share, provided Canopy can maintain its underlying fundamentals and market share.

Former Canopy Growth co-CEO Bruce Linton, who was the mastermind behind the deal to acquire Acreage and has since become executive chairman at U.S. cannabis company Vireo Health, told Yahoo Finance that either full legalization of marijuana at a federal level or a bill that would let states decide legalization for themselves without federal intervention would do more than just set Canopy and other cannabis companies up to double.

“As the states [those companies] are in go from one purpose — medical only — to medical and (recreational,) their market ramps up,” he said, adding that a double or tripling would be his minimum case. “I think they have the best exposure to ready-to-rip markets and under either scenario in 2020, why doesn’t it multiply?”

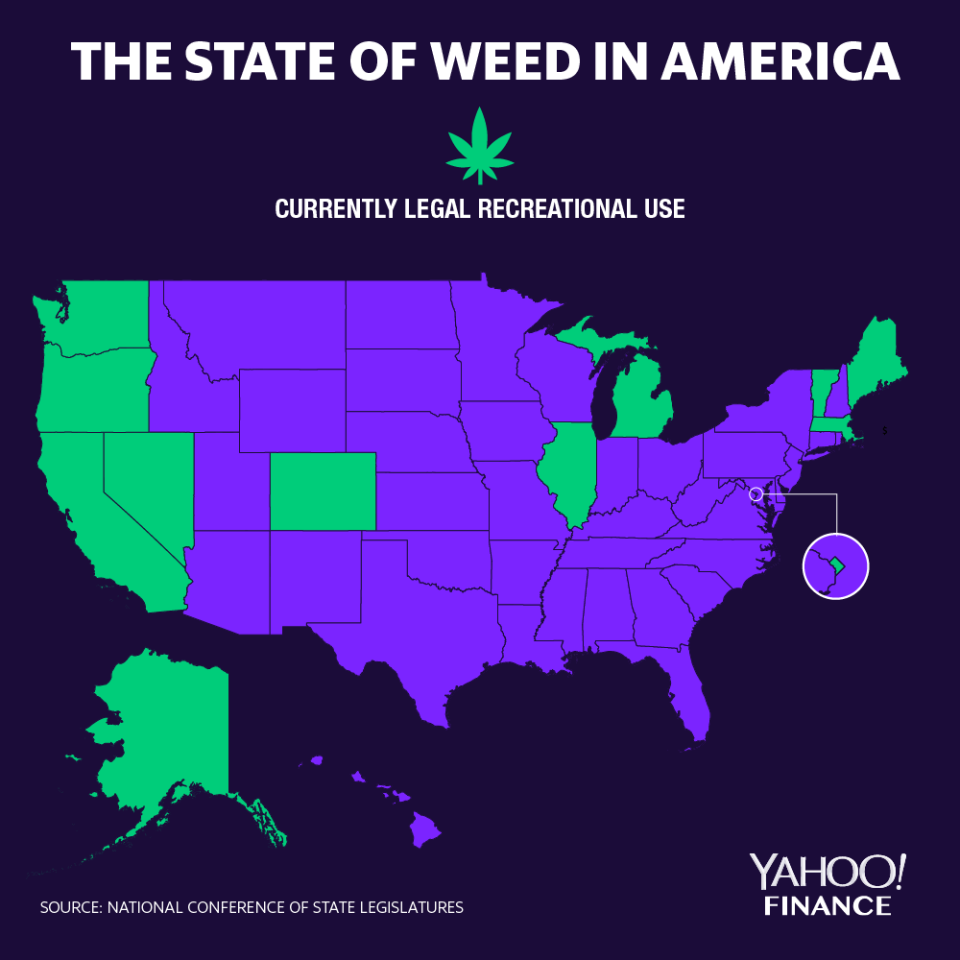

Interestingly, the discussion comes at a time when 11 states have approved recreational marijuana use and American voters now overwhelmingly support legalizing marijuana. According to a new Pew Research poll, two-thirds of Americans say marijuana use should be legal, while only 8% oppose both medical and recreational marijuana use.

A centerpiece of the presidential campaign

Perhaps noticing the changing views of voters on marijuana, leading Democratic candidates have made marijuana legalization a key piece of their platforms - from Senator Bernie Sanders saying he would legalize marijuana in his first 100 days in office, to Senator Kamala Harris saying she would direct marijuana tax revenue to marijuana entrepreneurs of color. Only Rep. Tulsi Gabbard and former Vice President Joe Biden stop short of full legalization.

As Nelson notes, there is still time for Republicans up for election in 2020 to shift stances on legalizing marijuana. With recent elections showing a drop in key Republican support in rural areas, a policy shift in an area with that much voter support could be warranted. Currently, the Senate led by Majority Leader Mitch McConnell has opted not to take up a banking bill that would allow banks to work with legitimate cannabis businesses in states that have legalized.

“The hold up is still going to be on the Senate side, but with some of the recent elections I think Republicans are going to shift some of their social policies as they lose some support in suburban areas,” Nelson said.

The passage of that bill, the SAFE Banking Act, might not be as much of a catalyst for the overall cannabis sector as full legalization would be, but it would nonetheless be a much needed boost for cannabis companies desperate for any shift to sentiment.

“The main problem is just sentiment and the cannabis companies continue to lose money quarter after quarter, and the U.S. market is about 10-times the size of Canada, so to open up that market opportunity would be huge,” Nelson said.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

Wall Street's first cannabis analyst names her top US marijuana stocks

Illinois becomes the latest state to legalize marijuana, these states may follow

The Farm Bill could end the multimillion dollar industry of cockfighting

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews,LinkedIn,YouTube, and reddit.