Why Elizabeth Warren is triggering billionaires

If you’re following Elizabeth Warren’s presidential campaign, you’re watching the most diabolically clever display of populism since Donald Trump ran for president in 2016.

Trump trounced a dozen seasoned competitors by finding a way to connect with “forgotten men and women” who dislike and distrust traditional politicians. Many of those voters are sticking with him, even if he’s not doing much to improve their lives.

Warren has made a similar connection with voters disgusted by corporate cronyism and the billionaire class. She has put a friendlier face on Bernie Sanders’ soak-the-rich crusade, and even kicked it up a notch with a wealth tax on multimillionaires and a corporate surtax on big companies that use loopholes to whittle their taxable income to practically nothing.

Wall Street has noticed, a sign that Warren is succeeding. Billionaire investor Leon Cooperman excoriated Warren for bashing the rich and said he’d support Mike Bloomberg if he enters the race. JP Morgan Chase CEO Jamie Dimon complained that Warren is “vilifying successful people.” Microsoft co-founder Bill Gates suggested Warren’s wealth tax is excessive, pointing out that he has already paid $10 billion in lifetime taxes and pledged most of his wealth to charity.

Warren responded to her billionaire critics by trolling them on Twitter and launching a wealth-tax calculator allowing billionaires to see how much they’d owe if her plan were in effect. She couldn’t have played it better. The billionaires are giving her free publicity, and she’s using it to make sure everybody knows why billionaires don’t like her: She’d take some of their money and spend it on education, child care and health care for the working class.

It gets better, because Warren will probably never get her wealth tax, even if she becomes president. The U.S. Constitution says that such taxes must be apportioned among the states in a way that’s proportional to population, which means the tax rate would vary by state and in some states be prohibitively high. There’s disagreement on whether a wealth tax is unconstitutional, but if passed into law it would undoubtedly end up in court, and possibly a Supreme Court with a conservative majority. So Warren can champion a wealth tax knowing she may never have to defend it, in reality.

Moderated policy outcomes

Warren is also triggering wealthy investors worried she would wage war on corporations and send stocks plummeting. Here, too, Warren is talking up things unlikely to ever happen. Almost all of her big plans would have to be passed by Congress, which means she’d need Democratic control of both the House and the Senate. And even then, she’d be constrained by a narrow majority in the Senate, which is the best Democrats can hope for. “A narrowly divided Senate would likely moderate policy outcomes,” Goldman Sachs explained in a recent report, “as the marginal vote needed to attain a simple majority would likely support more incremental changes than what most presidential candidates are proposing.”

Warren, for instance, wants to ban fracking, the fossil-fuel extraction process that has made the United States one of the world’s top oil producers. That gives her street cred with hard-core environmentalists. But a president can’t ban an entire industry. That would take a law passed by Congress, which would require 60 votes in the Senate and therefore some bipartisan cooperation, which Warren would not get on this issue. She could try to rein in fracking through regulatory efforts, but much regulation happens at the state and local level, which the president doesn’t control. And if she reached too far with federal regulation judges would stop her, as they have stopped many of President Trump’s executive actions.

Of Warren’s many plans, the ones that are plausible, should she win, are stronger antitrust enforcement, along with modest reforms in education, energy, and health care. Congress could raise the business tax rate slightly, from 21% to, say, 25% or 28%. The top marginal income-tax rate might go back to 39.6%, after Trump and his fellow Republicans cut it to 37% in 2017. Capital gains taxes might rise modestly.

But it’s hard to see how the giant tax hikes Warren wants on businesses and the wealthy would get through any Congress. And modestly higher taxes wouldn’t in themselves hurt the stock market. We’ve had roaring markets many times before when taxes were higher than they are now.

This allows Warren to tout revolutionary plans and position herself as the bold change maker without having to answer for the troubling consequences of confiscating capital or putting people out of work. She can promise to take from the haves and give to the have-nots, then blame Congress when it won’t let her. Elizabeth Warren’s boldest plan of all may be picking epic fights she doesn’t have to win.

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman. Confidential tip line: [email protected]. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

Bloomberg can help Democrats, but not by running

Calm down about Elizabeth Warren wrecking the stock market

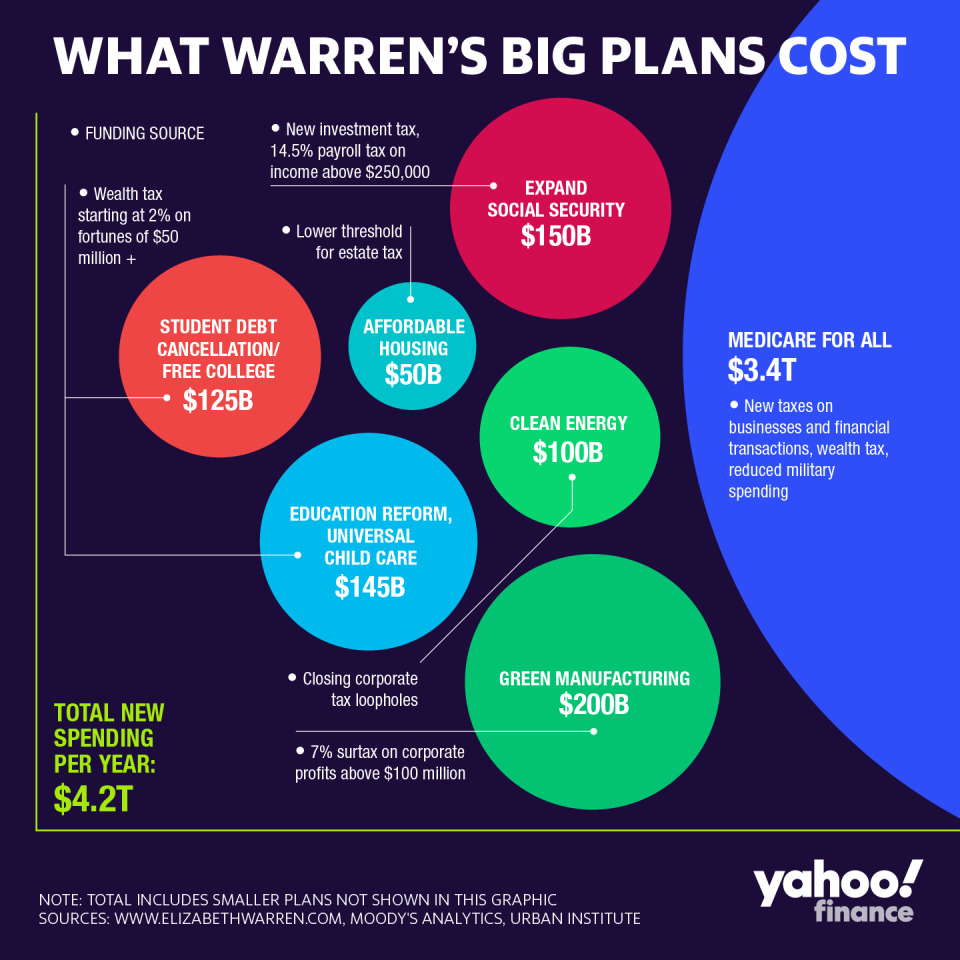

The staggering cost of Elizabeth Warren’s plans: $4.2 trillion per year

There aren’t enough doctors for Medicare for all

Why Democrats bomb with rural voters

4 problems with Andrew Yang’s free money drop

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance