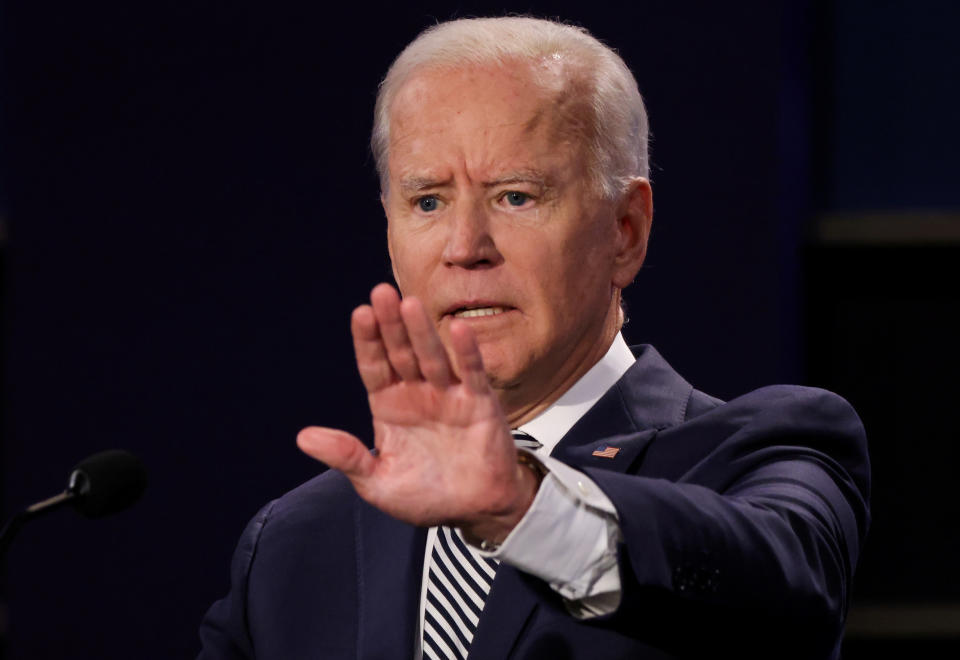

Why experts on both political sides say Biden's corporate tax proposal is 'problematic'

Among Joe Biden’s economic policy proposals, his plan to raise the U.S. corporate federal income tax rate to 28% from 21% has captured a lot of headlines. (Former Trump economic adviser Gary Cohn, for one, would support the higher rate.)

But a different bullet point within Biden’s tax plan does not sit well with a range of tax law experts—on both sides of the political aisle.

Biden aims to levy a minimum 15% tax on the “book income” of companies with at least $100 million in annual profit. “Book income” is the profit or loss that publicly traded companies report to shareholders in their quarterly earnings, and it doesn’t take into account taxes or legal tax deductions companies claim when they file to the IRS.

Experts say Biden’s 15% tax would end up hitting only about 250 U.S. companies thanks to the $100 million minimum—some of the largest corporations in the country. Because of Amazon’s (legal) tax-avoidance infamy, some people are calling Biden’s proposal an “Amazon tax.” But it would also hurt FedEx, and other large companies that have high capital expenditures (think energy, transportation, and logistics) and receive a range of legal tax breaks.

There’s obvious political appeal for Biden in a tax that would hit Amazon, but tax experts from both political parties don’t like the plan, for a number of reasons.

“Taxing book income is problematic from an economic perspective,” says Wharton accounting professor Jennifer Blouin.

She lays it out this way: Say a company has $100 million in book income one year, and purchased $80 million of equipment; thanks to U.S. bonus depreciation, the company has $20 million of taxable income. (Bonus depreciation allows a company to fully deduct the price of business purchases like machinery, rather than have to write it off every year over the course of the life of the asset; it’s meant to encourage R&D spending, and the Tax Cuts and Jobs Act of 2017 doubled bonus depreciation to 100%.) Under the current 21% corporate tax rate, the company would owe $4.2 million in taxes. But under Biden’s minimum 15% tax on book income, the company owes another $10.8 million (to get to $15 million, or 15% of its $100 million in book income). The tax would slash the company’s cash flows from operations to just $5 million.

“Doesn’t this effectively neutralize the point of bonus depreciation?” Blouin asks. “What about net operating losses, what about taxes paid in other jurisdictions? Consider that other countries may be offering investment incentives to subsidiaries of U.S. firms, so the Biden book tax basically unwinds other countries’ tax policies.”

That’s the issue many experts have: Biden’s book income tax creates a second tax system.

“It's a terrible idea,” says Douglas Holtz-Eakin, a Republican with the American Action Forum who was chief economic adviser to John McCain for his 2009 presidential campaign. Speaking earlier this month at a webinar on tax policy sponsored by Yahoo Finance and the Bipartisan Policy Center, Holtz-Eakin said, “You shouldn't have a tax system and an alternative tax system. You should have one tax system that you believe raises [tax] revenue in a fair and efficient fashion.”

Harvard economics professor Jason Furman, a Democrat who chaired the Council of Economic Advisers from 2013 to 2017 under President Obama, doesn’t like the Biden book income tax idea either: “Alternative minimum taxes are always an admission that your tax system has failed. I'd always rather fix the tax system as a whole. Better would be: get rid of the loopholes that give rise to the problem in the in the first place.”

Victoria Haneman, tax law professor at Creighton University School of Law and coauthor of the book “Making Tax Law,” sees Biden’s minimum book income tax as another version of the AMT for individual taxpayers (alternative minimum tax), which was repealed by the Tax Cuts and Jobs Act of 2017. “His proposal forces businesses to run two different tax numbers, just like with AMT,” she says. “The depreciation incentives are specifically put into the code to influence behaviors in a positive or negative way. We just got rid of the corporate AMT, and now we’re looking at bringing some other version of it into being.”

She also points out that in a broad sense, Biden’s plan represents the latest major change in U.S. tax policy, and that these frequent overhauls aren’t good for the country.

“Politics are driving a lot of these tax proposals, and whenever you have a major tax overhaul without bipartisan support, if political control shifts, there will be a legislative response from the new holder of power,” Haneman says. “It’s not durable. It creates wild fluctuations. Having frequent major tax code changes, there is a compelling argument that that is bad for business.”

—

Daniel Roberts is an editor-at-large at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

IRS tax guidance on fantasy fees could be major trouble for DraftKings, FanDuel

IRS adds specific crypto question to 2019 tax form

For Trump administration, Ant Group is not like TikTok

TikTok deal doesn’t make sense for Oracle beyond politics, analysts say

Amazon tells employees to delete TikTok, then says email was ‘sent in error’

Apple has less to fear from antitrust regulators than Google, Facebook, and Amazon