How Americans used their stimulus checks: Morning Brief

Consumers didn’t spend much of their stimulus checks

As emergency stimulus programs targeted at consumers expired, something unexpected happened: people kept spending. Friday’s September retail sales report confirmed as much.

Piecing together the government data, it seemed to be the case that consumers put much of their stimulus money away and have recently been drawing from those savings.

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Data released this week confirms that consumers were very aware of what they were doing.

The New York Fed surveyed 1,200 households and asked what they did with their economic impact payments, which included $1,200 checks for qualifying adults and an additional $500 per child. (89% of the respondents received a payment.)

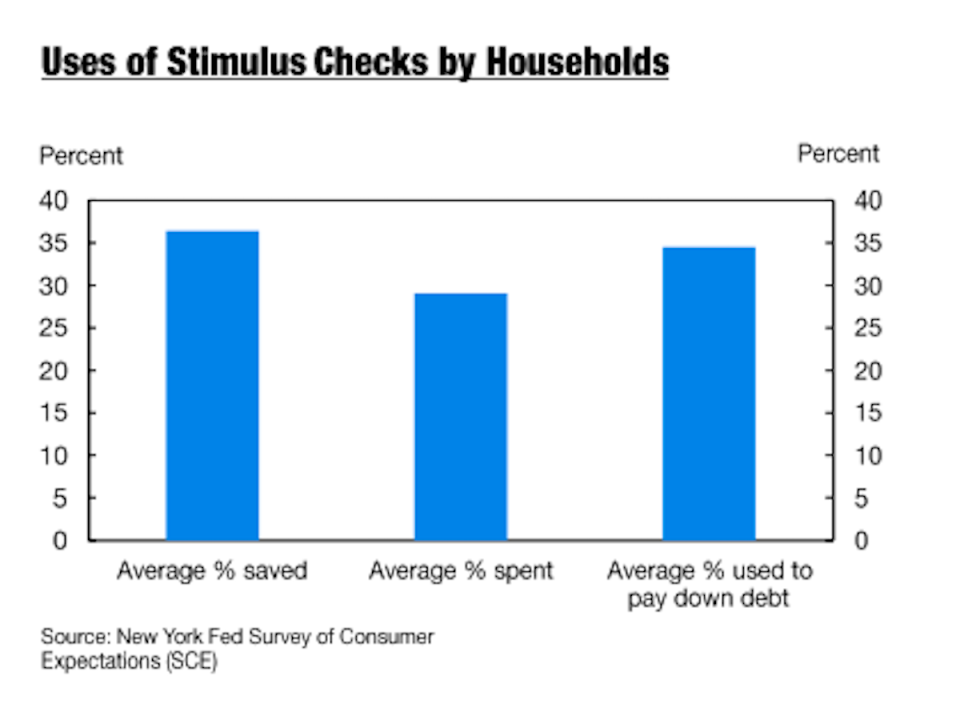

Of the stimulus money that went out, 29% was spent, 35% was used to pay down debt, and 36% was put away in savings.

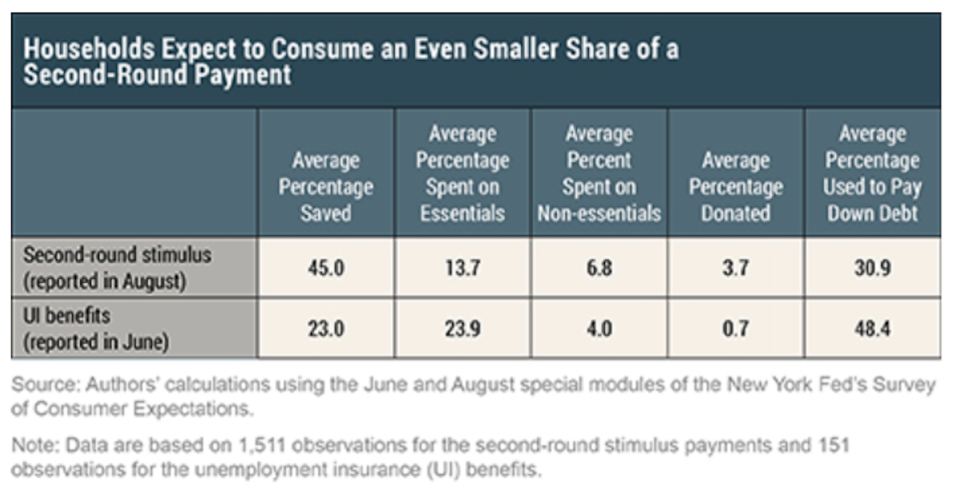

The New York Fed did another survey in August and asked what consumers would do with a potential second round of stimulus checks.

This time, respondents said they would spend 24% of it (about 14% on essential items and about 7% on non-essential items). Those respondents also said 31% would be used to pay down debt while 45% would be saved.

From all of this, we draw two conclusions.

First, this propensity to pay down debt and save suggests some spending may be pent up.

“The stock of savings accumulated since March suggests substantial upside risk to the economy,“ University of Oregon professor Tim Duy wrote this week in response to the New York Fed’s findings. “The possibility of a fiscal package after the election is another upside risk to the economy.“

Add to that a widely vaccinated population, and you may really see the spending floodgate open.

“At least in theory, a lot of potential consumer spending sitting in personal checking accounts and smaller-than-usual credit card balances just now,” DataTrek Research’s Nicholas Colas said. “To unlock that cash, consumer confidence must improve and Americans need to feel it is safe to return to many leisure activities still hurt by pandemic concerns (travel, in person dining, etc.).”

Second, if spending is what gets the economy really cranking, then the next round of stimulus may need to be different from what we’ve gotten so far.

“From a public policy perspective, the still likely extended period of high unemployment argues strongly for additional fiscal support,” Duy said, adding “but if much of the rebates and UI payments are being saved, we should be considering more targeted support or aid that we know will be entirely spent (aid to state and local governments).”

While it’s welcome news that the consumer-driven U.S. economy didn’t go off a fiscal cliff, the economy is still far from fully recovered. With post-coronavirus normalcy a ways off, we’ll have to look forward to some thoughtful stimulus soon as consumers continue to draw from their savings.

By Sam Ro, managing editor. Follow him at @SamRo

Top News

European stocks rebound after selloff [Yahoo Finance UK]

Trump, Biden go at it — from a distance — in town halls [AP]

U.S. Senate Judiciary Committee plans to subpoena Twitter CEO over blocking New York Post articles [Reuters]

Boeing Max declared safe to fly by Europe’s aviation regulator [Bloomberg]

YAHOO FINANCE HIGHLIGHTS

Exclusive: These airlines are most at risk of COVID-19-related default

'Slowing of momentum' in labor market may be a signal of small business closures: economist

How Captain America is taking on Trump days away the election

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay