Winners And Losers Of Q2: Lennox (NYSE:LII) Vs The Rest Of The HVAC and Water Systems Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Lennox (NYSE:LII) and the best and worst performers in the hvac and water systems industry.

Many HVAC and water systems companies sell essential, non-discretionary infrastructure for buildings. Since the useful lives of these water heaters and vents are fairly standard, these companies have a portion of predictable replacement revenue. In the last decade, trends in energy efficiency and clean water are driving innovation that is leading to incremental demand. On the other hand, new installations for these companies are at the whim of residential and commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 8 hvac and water systems stocks we track reported a solid Q2. As a group, revenues beat analysts’ consensus estimates by 2.3%.

Stocks, especially growth stocks with cash flows further into the future, had a good end of 2023. On the other hand, this year has seen more volatile stock market swings due to mixed inflation data. Thankfully, hvac and water systems stocks have been resilient with share prices up 6.8% on average since the latest earnings results.

Lennox (NYSE:LII)

Based in Texas and founded over a century ago, Lennox (NYSE:LII) is a climate control solutions company offering heating, ventilation, air conditioning, and refrigeration (HVACR) goods.

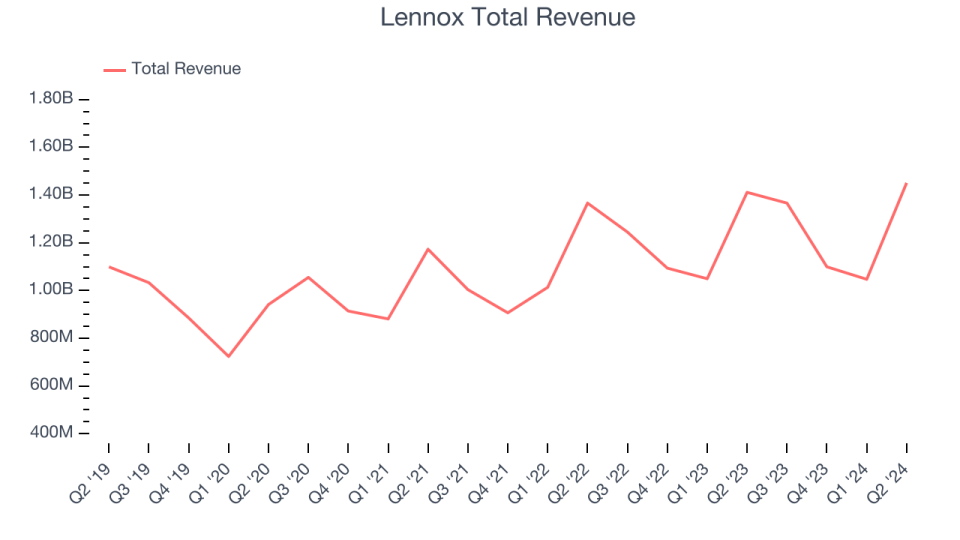

Lennox reported revenues of $1.45 billion, up 2.8% year on year. This print fell short of analysts’ expectations by 1.9%. Overall, it was a weaker quarter for the company with a miss of analysts’ organic revenue estimates and underwhelming earnings guidance for the full year.

"Our growth strategy and disciplined execution continues to yield impressive results," said Chief Executive Officer, Alok Maskara.

Interestingly, the stock is up 3.8% since reporting and currently trades at $590.19.

Is now the time to buy Lennox? Access our full analysis of the earnings results here, it’s free.

Best Q2: Northwest Pipe (NASDAQ:NWPX)

Playing a large role in the Integrated Pipeline (IPL) project in Texas to deliver ~350 million gallons of water per day, Northwest Pipe (NASDAQ:NWPX) is a manufacturer of pipeline systems for water infrastructure.

Northwest Pipe reported revenues of $129.5 million, up 11.3% year on year, outperforming analysts’ expectations by 8.7%. It was an incredible quarter for the company with an impressive beat of analysts’ earnings estimates.

The market seems happy with the results as the stock is up 15.3% since reporting. It currently trades at $43.98.

Is now the time to buy Northwest Pipe? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Advanced Drainage (NYSE:WMS)

Originally started as a farm water drainage company, Advanced Drainage Systems (NYSE:WMS) provides clean water management solutions to communities across America.

Advanced Drainage reported revenues of $815.3 million, up 4.8% year on year, falling short of analysts’ expectations by 2%. It was a weak quarter for the company with full-year revenue guidance missing analysts’ expectations.

Advanced Drainage had the weakest full-year guidance update in the group. Interestingly, the stock is up 5% since the results and currently trades at $156.76.

Read our full analysis of Advanced Drainage’s results here.

CSW (NASDAQ:CSWI)

With over two centuries of combined operations manufacturing and supplying, CSW (NASDAQ:CSWI) offers special chemicals, coatings, sealants, and lubricants for various industries.

CSW reported revenues of $226.2 million, up 11.2% year on year, surpassing analysts’ expectations by 4.9%. Revenue aside, it was an exceptional quarter for the company with a solid beat of analysts’ earnings estimates.

The stock is up 14.9% since reporting and currently trades at $344.17.

Read our full, actionable report on CSW here, it’s free.

AAON (NASDAQ:AAON)

Backed by two million square feet of lab testing space, AAON (NASDAQ:AAON) makes heating, ventilation, and air conditioning equipment for different types of buildings.

AAON reported revenues of $313.6 million, up 10.4% year on year, surpassing analysts’ expectations by 10.5%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ earnings estimates.

AAON delivered the biggest analyst estimates beat among its peers. The stock is up 10.4% since reporting and currently trades at $95.93.

Read our full, actionable report on AAON here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.