Women have reversed hiring trends for top jobs in fund management, study shows

Since the explosion of asset management in 1990, men have taken about 90% of the new jobs created, a survey released Thursday shows. However, that trend has reversed sharply since 2015 as more institutional and individual investors have moved to passive investing strategies like robo-advisors and exchange-traded funds (ETFs).

Since 2015, data collected by research firm Morningstar show women asset managers have largely maintained their standing while men have seen their numbers sink in the nearly $10 trillion equity and fixed-income management profession.

Women are making notable gains, but men are still dominant in the industry. The data show the drop in men, while striking, only represents 2.7% of all male fund managers, according to Morningstar Senior Quantitative Analyst Madison Sargis, a principal author of the study.

“It looks striking because of how overwhelmingly large the number of men in fund management roles is relative to women,” Sargis said. “There’s still a long way to go until the industry reaches gender parity.”

The number of active equity and fixed-income fund managers increased by almost five times from 1,900 to 8,500 managers since 1990, Morningstar found. However, women have left and entered the industry in largely equal numbers, the result of the asset management industry’s reputation, perceptions of unequal promotional structure, harassment and a number of other issues, Yahoo Finance found in a recent report. That meant they did not benefit as the number of portfolio manager jobs expanded.

More recently, however, the number of men in the industry decreased as the number of portfolio-managers declined from 7,657 in 2015 to 7,400 in September 2017.

“The fact that we’re holding our own is a good thing but what I’d really like to see is those numbers actually going up,” said Meredith Jones, an alternative investment consultant and author of “Women of The Street: Why Female Money Managers Generate Higher Returns (And How You Can Too).”

That the overwhelming trend appears to have stabilized is positive, Jones said, but overall she’s “depressed” by the findings.

“These are trends I’ve been watching for more than a decade now and given the amount of money controlled by women and how involved women are in financial decisions these days it seems to me there should be a commensurate increase in the number of female investment professionals. And those numbers appear to be stuck,” Jones said.

Recent studies have shown that women now control more than half of the total wealth in the United States and the amount of wealth controlled by women is set to increase. Women also are playing a greater role in household finances.

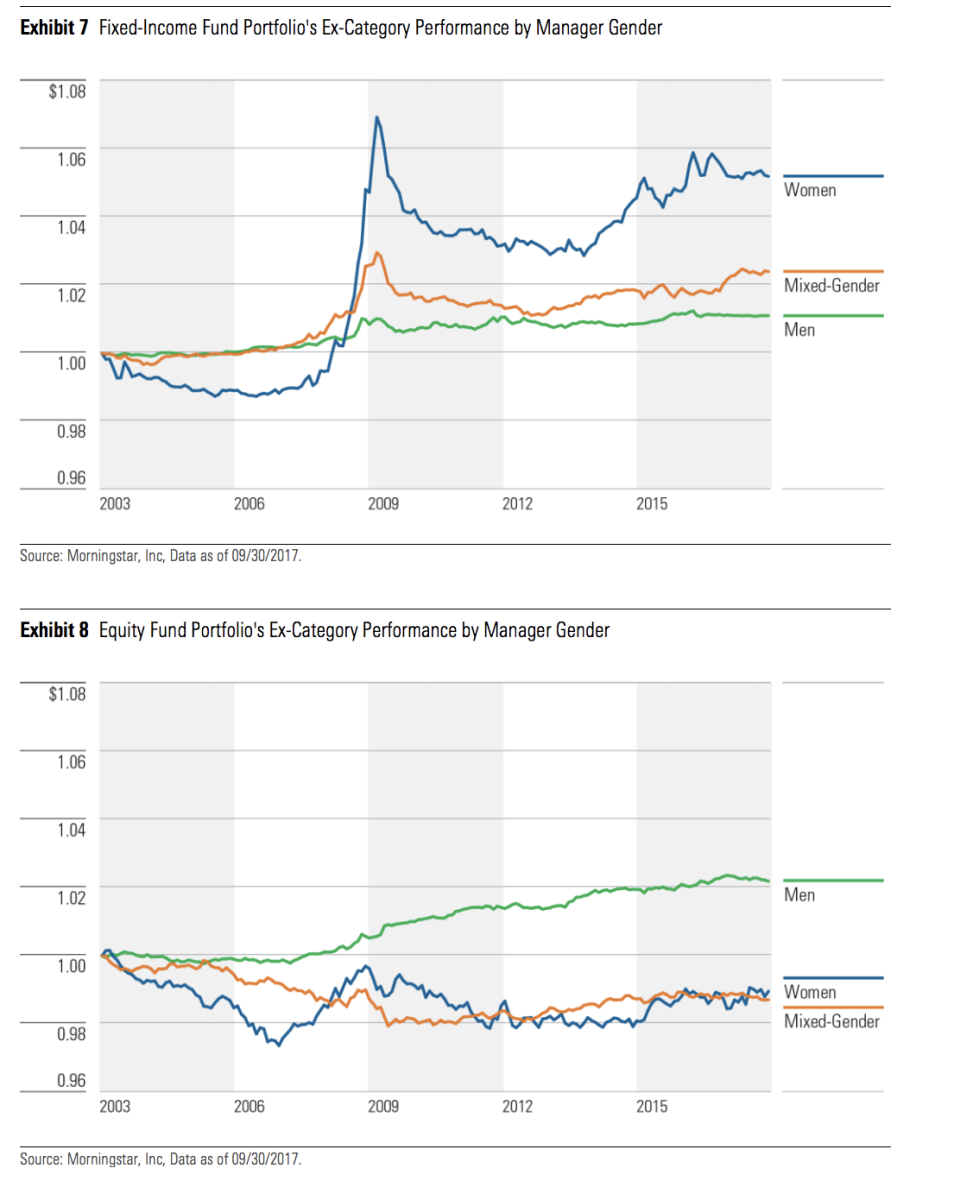

The disparity between the sexes in fund management doesn’t appear based on results, as Morningstar’s data found almost no difference in fund performance between investment funds managed by a team of women and those managed by men since 2003. It found that men marginally outperformed women and mixed-gender teams in equities, but women slightly bested men in fixed-income. (Interestingly, there were so few funds run by individual women, Morningstar excluded funds run by a single female fund manager from the data.)

“Our results indicate that the low participation rate of women in the industry is not justified by performance,” the report said. “If men and women deliver similar performance, diversity comes with no downside for fund investors.”

Morningstar data obtained by Yahoo FInance earlier this year showed that the number of women fund managers, while growing in absolute numbers, had been stagnant as a percentage from 2003 to 2017 in U.S. fixed-income and equity portfolios. Women’s growth has come from their increasing representation as asset managers for emerging markets, socially responsible investment and other specialty or niche funds.

The number of funds in those specialty areas has increased much more quickly than the number of total actively managed funds. The number of emerging markets has grown by 92% since 2003 while the number of U.S. diversified equity funds has increased by just over 7%.

“I suppose that as much as I wish that there had been a more dramatic shift, the fact that the number of women in the industry isn’t shrinking is something to be reasonably proud of,” Jones said. “You have to start from somewhere but given amount of financial acumen and power women are getting I would like to see these numbers increase significantly.”

—

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.