Your paltry savings from the Trump tax cuts

Remember those one-time bonuses some big companies announced at the start of 2018, when a large corporate tax cut went into effect? They added up to $28 per American worker.

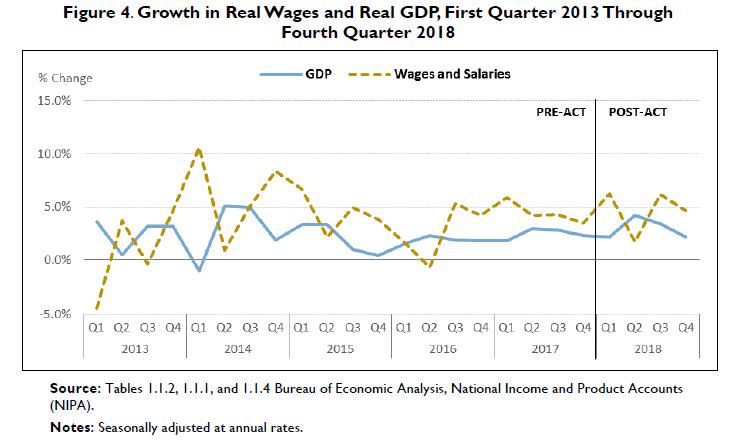

Other aspects of the Trump tax cuts were barely more generous to ordinary workers in 2018, according to new analysis by the nonpartisan Congressional Research Service. The law slashed the average corporate tax rate companies actually pay by 48%, while cutting the average rate for individuals by just 4%. The tax cuts had a minimal impact on GDP growth last year, and overall incomes rose just 2% when adjusted for inflation.

“On the whole,” CRS found, “the growth effects [of the tax cuts] tend to show a relatively small (if any) first-year effect on the economy.”

The Tax Cuts and Jobs Act, passed at the end of 2017, cut the corporate tax rate from 35% to 21%, while lowering the marginal tax rates most individuals pay. It also changed the way taxpayers itemize deductions, including the controversial new cap of $10,000 on the deductibility of state and local taxes. The overall cost will be about $1.5 trillion in foregone federal revenue through 2027, with annual deficits already soaring toward $1 trillion.

About two-thirds of Americans got a tax cut in 2018, but most of the gains went to the highest earners. That’s partly because they pay the most in taxes. The law, which passed with only Republican votes, could have kept the top brackets intact instead of lowering them, while directing larger tax cuts toward the middle class. But it didn’t, with the bill’s backers arguing more money in the wallets of the wealthy would stimulate spending and growth. Many economists dispute such “trickle-down” theory, and the CRS report finds no such stimulus in 2018, as this chart indicates:

There was broad agreement that the top U.S. corporate rate of 35% was too high, since it’s much lower in other developed countries. But it probably didn’t need to go as low as 21%. White House economists said lowering the corporate rate to that level would eventually boost household incomes by $4,000 to $9,000 per year. Treasury Secretary Steven Mnuchin and other Republicans argued the tax cuts would generate so much growth and new tax revenue that they’d pay for themselves. There’s no sign either of those things is happening, either.

Biggest effect: buybacks

The biggest effect of the tax cut in its first year was a record-breaking surge in corporate stock buybacks. Public companies repurchased $806 billion worth of shares in 2018, 55% more than the year before. Buybacks could go even higher this year. There’s nothing inherently wrong with buybacks, but nobody touted the Trump tax cuts as a needed buyback stimulator.

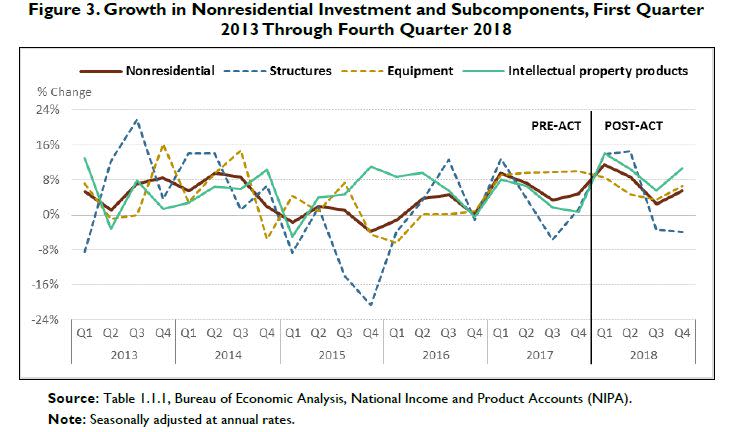

Companies buy back shares when they think it’s a better use of capital than spending it on equipment purchases or research and development or new investments. That doesn’t mean corporate investing has stopped. Nonresidential fixed investment grew 7% in 2018, which sounds good. But it’s not a notable increase from prior years, as the chart below shows. And other factors explain some or most of it. “It would be premature to conclude that the higher rate of growth of nonresidential fixed investment was due to the tax changes,” CRS found.

One-time bonuses vs. wage increases

Wages have picked up in 2019, but there’s still little evidence companies are passing tax savings along to their employees. About 1,900 companies announced one-time bonuses related to the tax cuts last year, according to Americans for Tax Fairness. In total, they committed about $4.4 billion to bonuses for about 5.4 million workers, or about $815 per worker. That’s real money, but not enough to change the picture nationally. When averaged across the entire U.S. workforce, the bonuses were only $28. One-time bonuses can even work against workers if they come in lieu of annual raises, since they don’t boost base pay or compound future earnings.

The tax cuts lowered the average effective tax rate American workers actually pay from 9.6% in 2017 to 9.2% in 2018. On median household income of around $63,000, that would be an annual savings of $252. No wonder polls have consistently shown Americans disapprove of the tax law, which factored into Democrats’ retaking of the House of Representatives in last year’s midterm elections.

Businesses, however, have reason to love the tax law, since it cut the average rate businesses actually pay, after credits, deductions and write-offs, from 17.2% to 8.8%, according to CRS. If applied to Apple, which earned a $60 billion profit in 2018, that would be a savings of $5.3 billion. Apple set aside $300 million for tax-related employee bonuses last year. And it only did that once.

Confidential tip line: [email protected]. Encrypted communication available. Click here to get Rick’s stories by email.

Read more:

The Trump stock-market rally looks like it’s over

Where Obama beats Trump on the economy

What GM wants from Trump on trade

Trump’s low threshold for stock-market pain

How Trump is blowing it with voters

Rick Newman is the author of four books, including “Rebounders: How Winners Pivot from Setback to Success.” Follow him on Twitter: @rickjnewman

Read the latest financial and business news from Yahoo Finance