In This Article:

Paychex, Inc. PAYX has reported impressive first-quarter fiscal 2025 results, wherein earnings and revenues beat the Zacks Consensus Estimate.

See Zacks Earnings Calendar to stay ahead of market-making news.

PAYX’s earnings of $1.2 per share beat the Zacks Consensus Estimate by 1.8% and increased 1.8% from the year-ago quarter. Total revenues of $1.3 billion outpaced the consensus estimate by a slight margin and gained 2.5% from the year-ago quarter.

The company’s shares have gained 11.7% in the past six months compared with the 11.9% and 11.8% rallies of the industry and the Zacks S&P 500 composite, respectively.

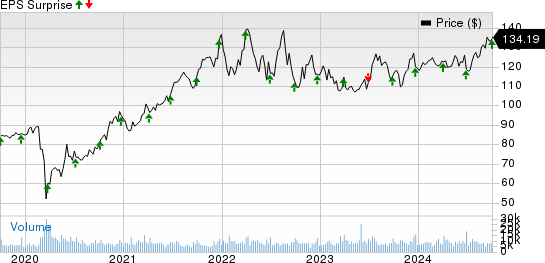

Paychex, Inc. Price and EPS Surprise

Paychex, Inc. price-eps-surprise | Paychex, Inc. Quote

Quarter in Detail

Revenues from the Management Solutions segment increased 1% on a year-over-year basis to $961.7 million, beating our estimate of $958.2 million. Professional employer organization (“PEO”) and Insurance Solutions’ revenues totaled $319.3 million, up 7% from the year-ago quarter. The figure missed our estimate of $320.2 million.

Service revenues of $1.3 billion gained 2% year over year, flat with our estimate. Interest on funds held for clients jumped 15% from the year-ago quarter to $37.5 million, missing our projection of $38 million.

EBITDA of $585.5 million gained 1% from the year-ago quarter, outpacing our estimate of $577.3 million. Operating income increased 2% year over year to $546.7 million, surpassing our projection of $533.2 million. The operating margin was 41.5%, down 20 basis points from the year-ago quarter. The reported figure beat our estimate of 40.5%

Balance Sheet & Cash Flow

Paychex exited the first quarter of fiscal 2025 with cash and cash equivalents of $1.5 billion, flat with the preceding quarter. The long-term debt totaled $798.7 million compared with $798.6 million in fourth-quarter fiscal 2024.

Cash generated from operating activities amounted to $546.1 million, while capital expenditure totaled $35.6 million.

FY25 Guidance

PAYX expects interest on funds held for clients to be $145-$155 million. The company anticipates other income to be $30-$35 million.

Paychex carries a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Snapshots of Peers

Republic Services, Inc. RSG reported an impressive second-quarter 2024 results.

RSG’s earnings per share (excluding 1 cent from non-recurring items) of $1.6 beat the Zacks Consensus Estimate by 5.2% and increased 14.2% from the year-ago quarter. Revenues of $4 billion beat the consensus mark by a slight margin and gained 8.6% year over year.